Empowering Women Through Financial Inclusion: Women's World Banking

Discover the partners, insights, and solutions that made this possible—and how we are scaling our work to empower the 700 million women still excluded. Download our infographic.

A Milestone Achieved. A Movement Accelerating.

We are thrilled to share we have now reached 117 million women and 76 million men in just eight years, expanding access to financial tools that support stability, income, and opportunity!

Each number represents a powerful story of progress—a woman launching a livelihood, protecting her family, or expanding her independence.

As women’s financial lives evolve, we are accelerating the next generation of inclusive products, policies, and investments—ensuring that even more women can build secure and prosperous futures.

Championing the Empowered Woman

Women’s World Banking is dedicated to securing the financial future of the economically empowered woman. She has access to financial and technological tools in her own name and is comfortable using them. She makes financial decisions for herself and her household, ensuring she has options for her own professional and personal growth, her kids stay in school and her family’s health needs are met. She votes, and if she’s a business owner, she is treated as one. She actively contributes to climate solutions and a sustainable world. She supports her community, invests in her family, and helps boost the economy for all of us.

There's no economic growth without her.

Women’s World Banking President & CEO Mary Ellen Iskenderian reflects on how far the organization has come—from a small group of visionaries with a big idea to a global force helping millions of women access financial tools and services.

Women’s economic empowerment begins with financial inclusion.

Financial inclusion is more than owning an account or getting a loan. It ensures every woman has the knowledge, skills, and trust in the financial system, accessing responsibly delivered, thoughtfully designed digital financial products and the appropriate technology to access them.

Financial inclusion includes:

- Secure and affordable payments, money transfers, and savings

- Credit for business growth and major purchases

- Insurance and pensions for financial protection

- Financial and digital education

Access, knowledge, trust, and choice lead to economic empowerment.

— Eden Tadesse, CEO of Invicta in Ethiopia

How We Do This

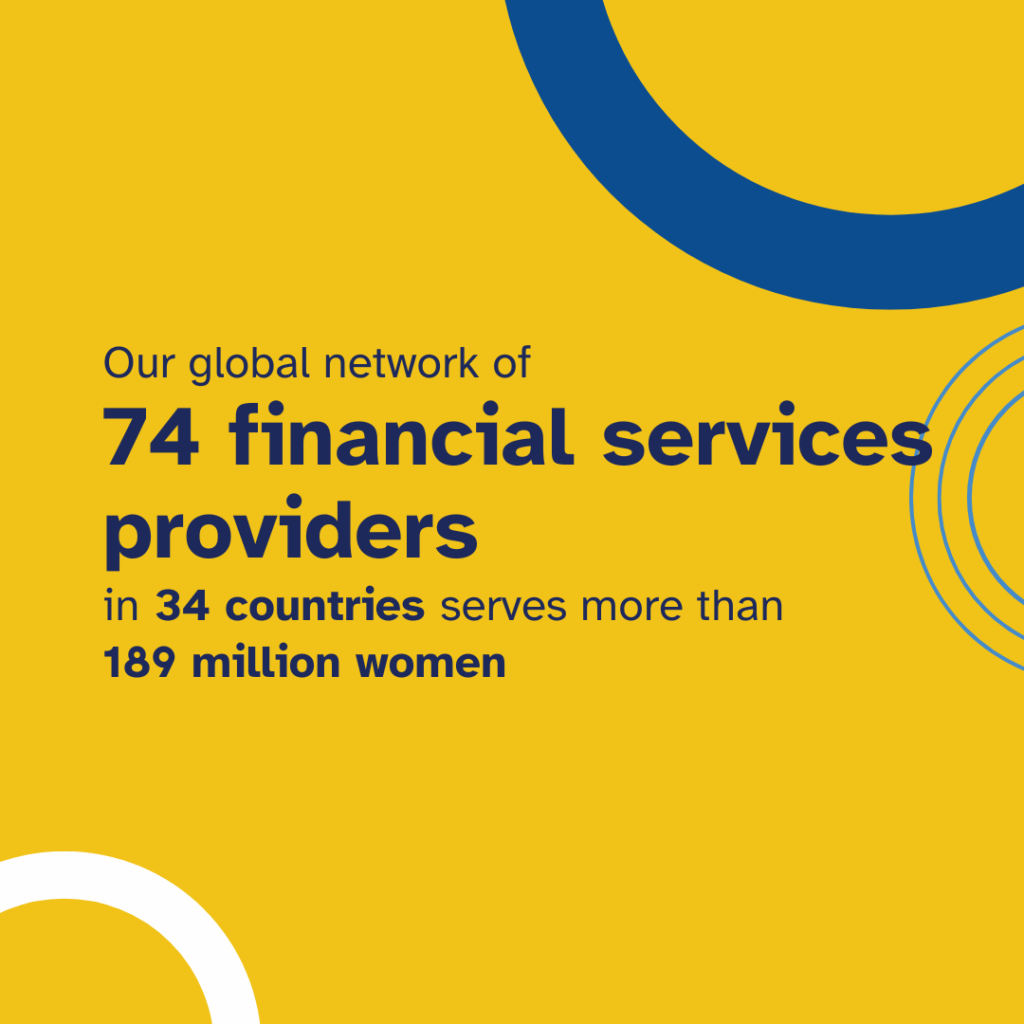

117 Million Women and Counting

To date, we have reached more than 117 million women in emerging markets through our programs, helping to change not only their lives but the lives of their households, communities, and businesses.

What do we mean by reached?

Women’s World Banking uses the term “reached” to describe any woman who can benefit from our programs to enhance financial inclusion, defined as giving women the choice to access and capability to use financial services. This includes:

- Women who have access to new or enhanced products or services, delivered directly in partnership with financial services providers.

- Women projected to benefit from products, services, or policies that deepen their financial inclusion, through investment and influence with financial service providers and policymakers.

Gender Lens Investing

Women’s World Banking Asset Management (WAM) invests in growing businesses with innovative solutions that enable women to achieve economic empowerment and resilience. Our goal is to create enterprise value and deliver competitive financial returns by investing in businesses that unlock the potential of women as customers, leaders, and employees.