By Whitney Mapes, Elwyn Panggabean

For low-income women worldwide, digital financial services can act as a stepping stone to greater financial inclusion, yet barriers to activating usage have prevented women from realizing their full benefits. Among the many obstacles women face to using digital financial services are a lack of financial and digital literacy, a lack of awareness of the basics and benefits of digital accounts, and limited ability to conduct transactions on their own. As a result, women may only minimally engage with their digital accounts or remain entirely inactive, failing to take advantage of all that digital financial services have to offer.

To address this usage gap, Women’s World Banking previously worked with Dutch Bangla Bank (DBBL) in Bangladesh to develop a digital account activation solution. Prior to the project, women factory workers, who received wages in a digital account, were cashing out their salary at ATMs without taking full advantage of other account services. Our solution helped these women learn how to make peer-to-peer transfers on their own. From September to December 2019, we conducted a pilot program of our solution with nearly 60,000 women. As a result, we found women were more likely to transfer money or conduct other transactions – 19 percentage points more likely to make transfers once they learned how to complete a transfer on their own. These women also made more frequent transfers 2+ times per month, as well as larger transfer amounts (126% increase) compared to a control group of customers who did not receive the solution.

Earlier this year, we have continued this work by replicating the account activation solution with Wing Bank, one of Cambodian leading mobile money providers with over 12 million customers. They have faced a similar challenge to DBBL, in which Wing’s payroll customers receive factory salary payments directly into mobile wallets, but choose to cash-out their full payments over the counter with Wing’s agent network rather than use their account or Wing Money app to make financial transactions.

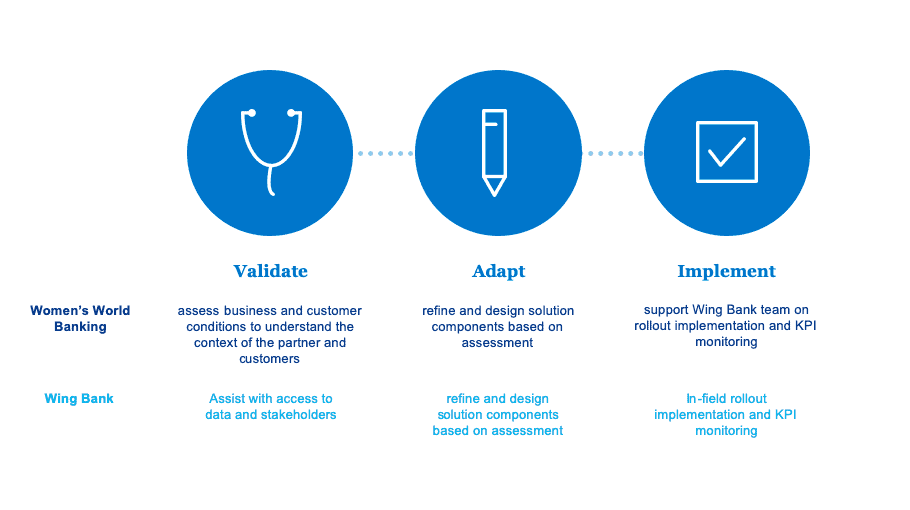

Women’s World Banking’s approach to replication

Women’s World Banking uses a three-phase approach to replicate solutions that have been developed in other markets and/or with other financial services partners. Replication allows us to scale solutions in a shorter project timeline. In the first phase, we led an assessment of the Wing business operational and customer conditions relevant to the digital account activation solution. Then, we worked collaboratively with Wing Bank to adapt the solution components based on our assessments, and developed and executed a detailed implementation plan to launch the solution for Wing Bank customers. In the final roll out phase that is currently in progress, Wing Bank is taking ownership of the solution delivery and monitoring, with continued support from Women’s World Banking to evaluate effectiveness and recommend additional actions to adjust, expand, or scale the solution.

The solutions and benefits

Emphasizing a learning-by-doing process, the solution components aim to develop women’s digital financial capability by improving their knowledge about the account, enabling them to use their account and conduct transactions confidently by their own. Three key solution components are critical to achieving this behaviour change, which we adapted from the original solution to meet Wings specific needs. These include:

- Learn-by-doing education module:

To address the knowledge gap about their Wing Bank’s account and its benefits, we offer a learning opportunity on the fundamentals of their account and the full range of available services. We design the learning process with practical learn-by-doing tutorials which include money transfers, phone top-ups, and bill payment. Those are the most relevant and important transactions for the women, especially during Covid-19.

- Leveraging familiar and trusted customer touchpoint:

Wing Bank has a large and accessible agent network, with around 10,000 Wing Cash Xpress agents across Cambodia where women are currently cashing out payments. However, we learned that agents have limited time and motivation to help educate customers– especially during high volume periods of salary disbursement when hundreds of payroll customers come to cash-out their payments at the same time.

Instead, we focused on existing, day-to-day factory relationships—and leveraged the key roles played by factory administrators and team leaders—to develop the right customer touchpoint. Seen as an authority on Wing and the payroll process, the factory administrator is tasked with training team leaders on the Wing account. In turn, the team leaders pass on this information to women workers in informal, interactive, and more time-efficient, coaching sessions. Because team leaders directly supervise women workers and have more established, personal, trusted relationships with them, women feel more comfortable in these smaller sessions.

- Targeted and multi-channel communication strategy:

Through a signage campaign, we inform women workers about the factory-wide educational initiative, in which women learn about the Wing account from their team leaders. We ensure these posters are displayed in high traffic, high visibility areas throughout the factory, such as canteens, bathrooms, and bulletin boards. To reinforce and encourage usage of the Wing account, women will also receive digital follow-up messages that coincide with their salary payments.

| DBBL | Wing Bank | |

| Learn-by-doing module |

|

|

| Communication strategy |

|

|

| Customer touchpoint |

|

|

Impact of increased digital account activation and implications for future replication efforts

Wing Bank’s rollout of the account activation solution immediately helps customers to learn about their Wing Bank account and how to conduct transactions that address their individual needs. In learning how to be an independent account user, women gain greater confidence and awareness of immediate account benefits, like the convenience of conducting transactions anywhere, anytime via their electronic devices. This process of enhanced learning-by-doing and confidence building will encourage women to start, continue, and increase their usage of the Wing account.

Building digital financial capabilities will also empower women to increasingly take ownership of their finances. In the long term, the account activation solution enables women to achieve greater financial autonomy and increase their decision-making power vis-à-vis their Wing Bank account and overall finances. While this particular solution focuses on basic use cases to start, it aims to establish a foundation for deeper personal account engagement and adoption of other financial services over time that will improve the financial resilience of low-income women in Cambodia. To monitor this impact, we will also be conducting outcome research with an end-line assessment in 2022.

Our collaboration with Wing Bank represents the successful replication of a solution in our target market, Cambodia. Through replication, the rollout stage is shortened substantially, resulting in a solution for Wing delivered at a fraction of the time and cost of the original solution developed for DBBL in Bangladesh. Further, this latest success demonstrates significant potential to scale the same replicated solution with other financial services providers elsewhere as employers and labor organizations are showing greater interest in digital wage payments as a more convenient cost-effective, and contactless transition from cash. As such, this account activation solution can provide a helpful blueprint for optimizing the customer experience in the wage digitization process and enabling women to enjoy the full benefits of digital financial services.

Women’s World Banking’s work with Wing Bank is supported by the Australian Government through the Department of Foreign Affairs and Trade.