By Angela Ang, Andi Setianto, Whitney Mapes, and Elwyn Panggabean

As COVID-19 has exposed economic fault lines around the world, governments have responded by extending economic lifelines to the most vulnerable populations. According to the World Bank, at least 200 countries and territories have offered some kind of COVID-19-related financial relief. One of the major questions amidst this rise in payments is under what conditions government-to-person (G2P) payments encourage sustained engagement with financial services.

The Government of Indonesia—and specifically the Ministry of Social Affairs (MoSA)—has made remarkable strides in its efforts to advance financial inclusion for women. Since 2017, Indonesia’s conditional cash transfer program, Program Keluarga Harapan (PKH or the Family Hope Program), enlisted state-owned banks to open digital financial accounts for 10 million beneficiaries, many of whom are women. While this program improves access to formal financial accounts for women, who largely have a banking account for the first time, previous research by Women’s World Banking has shown that 91% of the account usage is limited to cash withdrawals, not long after receiving the G2P fund in their account. This demonstrates that it is not sufficient to provide only access/accounts for women, but there must be efforts to drive engagement with these accounts so women feel motivated and empowered to use them, and get the full benefits of having a formal financial account.

Over the past year, Women’s World Banking has collaborated with Bank Negara Indonesia (BNI), one of the largest state-owned banks involved in the PKH payment, with support from MoSA. We have developed account activation/engagement solutions to build the capability of women PKH beneficiaries so they could actively use their G2P accounts beyond G2P transactions, such as for savings and funds transfer.

Our approach to solution design

Using our women-centered design approach, we defined a problem space and explored it through deep customer research. Then, we entered the design phases of ideation, and user testing before arriving at our final solutions, which will be tested on a pilot implementation that began in October 2020.

Our research into the PKH ecosystem identified four specific behavioral barriers that prevent beneficiaries from more actively using their bank account.

- No active choice to open their BNI account: PKH recipients were automatically assigned to BNI to receive PKH payments and were opened in bulk, so the customers were not provided adequate education and training on how to use their BNI accounts.

- Low awareness of account and lack of capability to conduct transactions: Three-quarters of PKH beneficiaries did not know basic information about their account, beyond withdrawing their G2P payment. They were also not confident and often depended on others to conduct transactions. Surprisingly, these issues were not only among PKH beneficiaries, but also among peer group leaders and even PKH facilitators.

- Lack of trust in the account: PKH Beneficiaries have unclear rules or guidance about how to use their accounts which fuels mistrust and confusion. Beneficiaries have received many conflicting messages about the account such as withdrawing G2P payments and/or not saving in their PKH accounts.

- Low perceived value of account: With such low awareness of the account and its potential uses, customers see it as having little value. However, when customers are aware and understand use cases, their account does present value—especially for savings and transfers.

This deeper understanding of customer barriers allowed us to move into the solution design process with a clear roadmap of the barriers our solution would need to overcome, primarily low awareness of the account and limited financial capability. To find ways to address the trust barrier, we looked at the PKH program ecosystem infrastructure as potential trusted touchpoints. The first is to leverage the existing PKH monthly meeting organized by the PKH facilitators called Family Development Sessions (FDS). The second is to look at the influencers of the PKH program who are well-respected and (physically) closer to the community such as the PKH Facilitators and the group leader.

Our early concept was Digital Financial Capability (DFC) and savings mobilization program jointly implemented by leveraging the existing PKH ecosystem. We choose savings as the main use case, based on the needs and common practices we found from the research. User testing gave us a chance to evaluate our prototyping and further refine the solutions. Through this process, we were encouraged to learn that PKH beneficiaries and peer group leaders were enthusiastic about participating in the savings program, as they did have desire to save but did not have the knowledge, skills, or discipline to do so. We also learned that beneficiaries struggled to understand common banking and financial terminology used by BNI, so we simplified the language to colloquial language that women would be more likely to use and offered a combination of visuals and short text whenever possible.

Our final account activation and savings mobilization solution

Our final solutions provide a holistic approach to helping PKH beneficiaries gain the knowledge, capabilities, and practical skills needed to start saving within their BNI account. Introduced through the PKH facilitators and peer group leaders in small group settings due to the suspension of the FDS monthly meetings during the pandemic, the individual solution components each provide a critical stepping-stone to address customer barriers and give PKH beneficiaries the necessary tools to successfully build a long-term savings habit.

Individual components of the solution are:

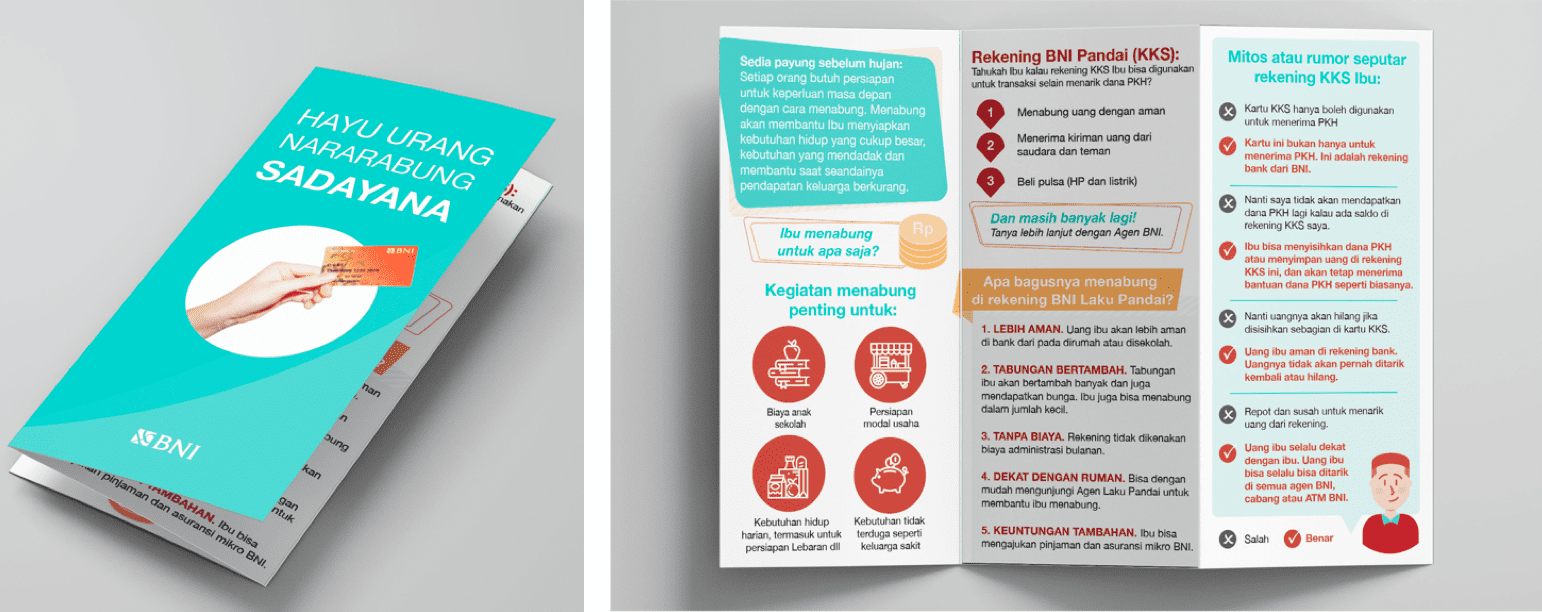

- Account education pamphlet: A visual pamphlet to educate beneficiaries about their account and its features, including dispelling rumors/myths about the account, savings benefits, how to save, and why they should save with BNI. This information will increase trust, comfort, and understanding of the account and its use cases.

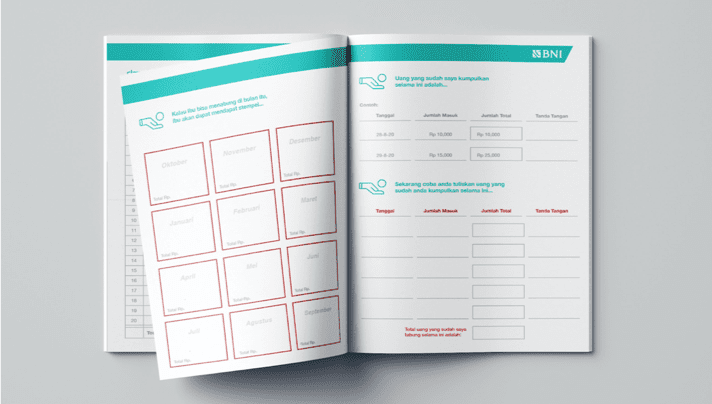

- Savings workbook: The workbook gives beneficiaries a step-by-step guide to getting started with savings. It is designed in a clear and simple order to guide women in planning their monthly expenses, set and commit to their personal savings goal, and track their savings over time. The savings tracker is also designed to motivate the customer to continuously save and achieve their personal savings goal.

- A saving box: A saving box (or “celengan”) gives women a physical place to save short term at home, with something that they are already familiar with and to save their time from visiting agents, before depositing the money into their account.

- Reminder messages: Beneficiaries receive messages once a week to nudge them to save, reinforce accomplishments, and help them stay on track with their savings goals.

The solution components provide the building blocks to creating a savings habit. As women learn more about the account, the benefits of saving in their bank account, and end-to-end savings activity, this change in knowledge and skills will help them feel more confident saving in their account and be more reassured of the security of their savings. Once a foundation of savings behaviors is established, women will grow their savings balances and build a long-term savings capacity.

Implications and next steps for the project

Our work on this project suggests that there is a greater role for government agencies and their financial partners beyond opening accounts and distributing G2P payments for beneficiaries. It also shows there is an opportunity to leverage the infrastructure of both BNI and MoSA to further accelerate the foundation for women’s financial inclusion and empowerment.

Although this work started pre-COVID-19, it has only become more relevant as economic insecurity and the number of people receiving government payments has increased. It is more critical now than ever to empower PKH beneficiaries to use their accounts as tools for recovery and resilience. Beneficiaries need to be able to use their accounts to save small amounts, to provide a safety net for household expenses and sudden emergencies when times get tough. They also need to be able to make digital payments and transfers to stay COVID-19 secure, and even apply for credit to help restart their businesses as they recover from the impact of COVID-19. If used to their full potential, these accounts can offer a lifeline to PKH beneficiaries to rebuild their financial lives in a post COVID-19 environment. We hope that experiencing the financial benefits of her own savings will help beneficiaries, and their households, be more economically empowered and less dependent on government assistance in the long term.

At this point in the project, we are progressing beyond testing to implementing our account activation solution with select groups of PKH beneficiaries. We look forward to sharing further updates on the program implementation and impact assessment in the coming months. We believe that the results should cover implications not only for the Indonesia/PKH program, but could give greater insights on how it can be carried forward in other countries with similar government support and infrastructure. Stay tuned!

Women’s World Banking’s work with BNI is supported by the Australian Government through the Department of Foreign Affairs and Trade and the Caterpillar Foundation.