In 2012, an estimated 64 percent of Nigerians were unbanked and had never accessed any formal financial services or products, a number that is higher for women: nearly 73 percent of all Nigerian women are unbanked. This number does not include figures for the underbanked—men and women who have had interaction with a bank but not consistently.

In Africa, and in many places in Nigeria, physical proximity to a branch is the most important barrier. However, in Balogun market, and in many urban areas across Nigeria, the distance is emotional instead of physical. The women and men who run businesses in Nigeria’s bustling Balogun market are familiar with banks yet they do not see them as relevant or accessible. Even those who have accounts usually place most of their money in traditional, though more informal, financial tools. Diamond Bank and Women’s World Banking, supported by Visa and EFInA, set out to close this gap by creating an innovative and relevant savings product that crosses the barriers preventing low-income Nigerians from accessing formal financial services.

Diamond Bank PLC is a universal bank offering a range of banking products and services in retail, commercial, corporate and investment. As technology and the advent of mobile money drives down the cost of doing business with clients, Diamond Bank saw a tremendous opportunity to grow their client base through serving the under-banked and financially excluded.

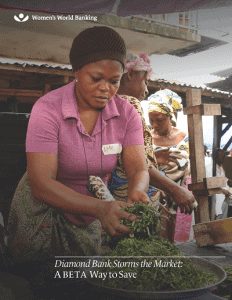

Diamond Bank worked with Women’s World Banking to deepen its understanding of this potential market and deliver a product efficiently and at low cost. As Diamond Bank learned, it is not that Nigerians do not want to keep their money at a bank, but that they need more convenient services than banks have previously offered. And most Nigerians want to engage with bank—61 percent of the unbanked would like an account. Bridging this gap requires a new model of simple, affordable and accessible products that meet the needs of low-income people. Given Women’s World Banking experience developing savings products for institutions all over the world, the partnership with Diamond Bank provided Women’s World Banking an opportunity to adapt this expertise to ensure that women were part of the bank’s growth strategy.BETA (meaning “good” in pidgin English) can be opened in less than five minutes and has no minimum balance and no fees. The account is targeted at self-employed market women and men who want to save frequently (daily or weekly). Because we know that these customers, especially women, value convenience, the product is built around serving women in the market where they work. Agents, known as BETA Friends, visit a customer’s business to open accounts and handle transactions, including deposit and withdrawal, using a mobile phone application.

Pilot Overview

- In March 2013, the BETA savings account rolled out in 21 of Diamond Bank’s 240 branches.

- 38,600 accounts were opened during the six-month pilot, 40 percent of them belonging to women, exceeding the goal of 16,000 accounts.

- 74 % of BETA clients transact more than once a month, saving an aggregate $1.5 million (US) in deposits in the first six months from the pilot launch.