By Ana Maria Prieto

Mrs. Ana Maria Prieto is currently Deputy Director at the Unit of Financial Regulation of Colombia where she has actively worked on the design and implementation of the strategy of financial inclusion and of financial education in Colombia. She was a panelist on the Making Finance Work for Women Summit session, Ask the Experts: G2P Payments in Response to COVID-19.

The COVID-19 emergency unleashed the adoption of social protection measures in practically all nations seeking to counteract its negative economic effects.[1] Many of these emergency schemes focused on informal workers who are not part of social protection databases, requiring construction of new registries and testing new delivery channels since most of this population is unbanked.

The implementation of these cash transfer programs has been a challenge to ensure that aid is delivered in a timely, safe, and efficient manner, without generating agglomerations or physical displacements of the population that lead to greater sources of contagion of the virus. The challenge has been even greater in those nations where there was no digital payment infrastructure.

In Colombia this year, in response to COVID-19, the Government created Ingreso solidario, a non-conditional transfer program targeting 3 million vulnerable households not covered by other social programs. Initially, the program was set for 3 monthly payments of around 42 dollars (April-June), but it was recently expanded until 2021.

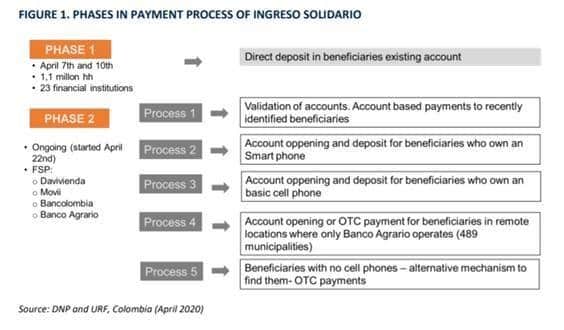

The Ministry of Finance designed the payment platform, prioritizing digital financial inclusion as a means to guarantee that aid is delivered on time, complies with social distancing, and contributes to overcoming the environment of informality that is perpetuated when payments are made in cash. The program has a clustered and staged design to tackle the numerous challenges posed by reaching new beneficiaries. The first stage was for those already with an account followed by the unbanked, who the Government set multiple strategies to include financially, mostly through mobile phone or SMS-based interactions with banks. In the far rural areas and for those “unreachable” beneficiaries, the aid was delivered by a cash transfer, with the help of financial agents and municipalities.

Overall, during the first part of the program, between April and June 2020, 2.6 million households were reached. Almost 1.2 million of beneficiaries were financially included, 76% through digital wallets backed by accounts at financial institutions, and 24% by a face-to-face process. Almost 65% of these beneficiaries were women, which was something the Government intentionally included in the targeting process since women are most impacted by the economic effects of COVID-19.

The main achievement of the program has to do with switching from regular money transfers to digital financial inclusion and digital usage for first-time users of mobile-based accounts. Preliminary data shows an impressive trend: 45% of the beneficiaries did an additional cash-in after payments and 62% of the people used the money on their wallet without leaving their homes, whether to pay utility bills, recharge their phones, make transfers to family members, or make electronic purchases. All of this resulted in greater consumption capacity and an improvement in household well-being.

These achievements were possible thanks to the efforts made by the Government and the private sector in the last years to foster financial inclusion. On one hand, there has been a special dedication in developing an enabling regulatory framework, with special rules to expand last-mile agents’ outreach and authorization of mobile-based accounts and simplified KYC processes with banks. On the other hand, the low value payment infrastructure has been under a modernization process with increased competition being promoted also from the regulatory side and the creation of a private Fast Payment Clearing House to increase interoperability standards in the market.

Ingreso Solidario managed to advance financial inclusion considerably and boost the digitalization of cash transfers across the country. It was also an opportunity to learn and innovate for the Government. To quickly respond to the emergency, there was flexibility in terms of delivery channels and methods, and co-design was part of the process with the private sector.

It is both feasible and imperative to consolidate this effort and develop a more robust and efficient G2P payment ecosystem to win the battle against informality and the extra-costs that spill from cash transactions. Since July 2020, the Social Prosperity Department of Colombia has managed the program, and their expertise in social protection has been very valuable to continue expanding coverage and standardize administrative requirements and process.

There remain many challenges. The payment platform needs to be more customer-centric and implement consumer choice for G2P beneficiaries to foster long-term relationships between households and the payment channel so that positive externalities of financial inclusion can flourish.

Also, there´s a need to have a consolidated registry of beneficiaries with digital ID, to avoid fraud and mitigate risks on digital onboarding. There´s a need to extend cash-out interoperability and in general move to a more inclusive digital payments ecosystem, something that needs the private sector’s willingness to keep amplifying their products and channels to the underserved.

To address part of these challenges, the Ministry of Finance recently launched a public policy document to enable financial sector development. It sets a mid-term agenda with more than 70 public actions, including the unification of the payment system regulation on the Central Bank, regulation of open banking and account portability, among many others. These efforts will be complemented with a new financial inclusion national strategy, which was launched recently by the Government.

The COVID-19 pandemic has highlighted the advantages of having a modern, automated, and agile transactional system that serves as the infrastructure of a digital economy. The experience gained from Ingreso Solidario during the pandemic could lead to a second generation of social protection programs in Colombia, moving away from cash to some form of digital payments to accelerate progress towards the Sustainable Development Goals.

Bibliography

Baur-Yazbeck S., Chen G. y Roest J. (2019). The future of G2P payments: expanding customer choice. Focus Note, CGAP.

BIS (2020). Payment aspects of financial inclusion in the fintech era. Committee on Payments and Market Infrastructures.

CGAP (2020). Rapid Account Opening in a Pandemic: How to Meet AML/CFT Rules for Social Assistance Payments. Insights for Inclusive Finance.

IMF (2020). Digital Solutions for Direct Cash Transfers in Emergencies, Special Series on Fiscal Policies to Respond to Covid-19.

Nika Soon-Shiong, Tebello Qhotsokoane and Toby Phillips. (2020). Using digital technologies to re-imagine cash transfers during the Covid-19 crisis, Digital Pathways Paper Series, University of Oxford.

World Bank (2020). COVID-19 G2P Cash-Transfer Payments Country Brief: COLOMBIA.

World Bank (2020). Responding to crisis with digital payments for social protection: Short-term measures with long-term benefits. World Bank Blogs.

[1] Gentilini U., Almendi M. (2020). Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures. World Bank