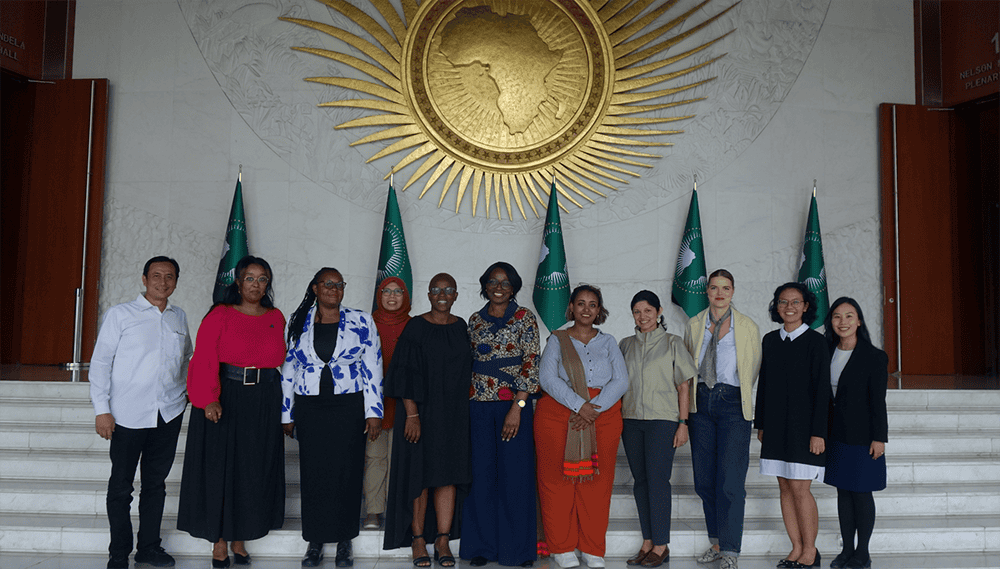

The Women’s Digital Financial Inclusion (WDFI) Advocacy Hub team recently met with coalition members and the larger women’s financial inclusion ecosystem in Addis Ababa. Ethiopia is home to one of the local coalitions, and two coalition members joined from Indonesia, home to the other local coalition (Dr. Arifah Rahmawati, Secretary of the Economic and Employment Council of the Central Leadership of Aisyiyah, and Dr. Erdiriyo, Deputy Assistant in Charge of Financial Inclusion & Islamic Finance at the Indonesian Coordination Ministry of Economic Affairs). Alongside our partner United Nations Capital Development Fund (UNCDF) , Women’s World Banking visited the African Union, where we met with Dr. Tapiwa Uchizi Nyasulu, Head of Women & Gender Policy and Development. She shared about the Women and Youth Financial & Economic Inclusion 2030 Initiative (WYFEI 2030), which aims to unlock USD 100 billion for at least 10 million women and youth by 2030, and how WDFI Advocacy Hub’s work contributes toward these goals.

Following this meeting, we visited the Organization for Women in Self-Employment (WISE), where we met with Executive Director Tsigie Haile and visited two capacity-building workshops: 1) training policymakers on the burden of unpaid labor so they can take that into consideration when developing policies affecting women; and 2) training heads of cooperatives on digital financial literacy so they can share with their members. Finally, we received a warm welcome from Samiya Abdulkadir Godu, Founder and President of the Ethiopian Youth Entrepreneurs Association (EYE-A), where she shared how her organization supports young entrepreneurs, especially in the areas of skills gaps, financial constraints, policy advocacy, and information sharing. This immersive field visit provided a firsthand view into how various members of the ecosystem are advocating for women’s financial inclusion and economic empowerment.

The WDFI Advocacy Hub captured the momentum created by FinEquity Africa’s Annual Meeting, hosting two insightful sessions and bringing together over 80 participants. The Cross-Coalition Learning Exchange session, moderated by Women’s World Banking’s Vitasari Anggraeni, Deputy Director of Southeast Asia Policy, featured panelists from both the Indonesian and Ethiopian coalitions, including Dr. Rahmawati, Dr. Erdiriyo, Samiya Abdulkadir Godu, Misikiru Solomon, Manager from ENAT Bank, and Tezera Kebede Bekele, CEO of Peace Microfinance. They reflected on the Ethiopian and Indonesian financial inclusion ecosystems and emphasized collaboration across sectors to drive impactful change.

In the Inclusive Policy to Accelerate Progress session, Women’s World Banking’s Yashmin Fernandes, Director of the WDFI Advocacy Hub, moderated a fireside chat where Financial Sector Specialist, Yasmin Bin-Humam from CGAP and Director of Programmes Shiphra Chisa from Graca Machel Trust shared global and regional perspectives on barriers and policy opportunities for women’s digital financial inclusion. Additionally, we heard insightful case study presentations from Dr. Erdiriyo of Indonesia’s Coordinating Ministry of Economic Affairs and Martha Hailemariam, Senior Advisor at the National Bank of Ethiopia. Additionally, we heard insightful case study presentations from Dr. Erdiriyo of Indonesia’s Coordinating Ministry of Economic Affairs and Martha Hailemariam, Senior Advisor at the National Bank of Ethiopia.

In the session’s closing remarks, Lilian Tan, Senior Program Officer, Women’s Economic Empowerment and Financial Inclusion, Bill & Melinda Gates Foundation, highlighted the Advocacy Hub’s calls to action to the ecosystem:

- Financial Services Providers – Design digital products/services that address women’s unique needs, ensuring affordability and consumer protection.

- Policymakers – Set specific targets to increase women-led MSMEs’ digital and financial inclusion and prioritize building digital financial capability.

- Civil Society Organizations – Advocate for measurable targets for women’s financial inclusion and utilize gender-disaggregated data to identify opportunities.

Learn more about the Women’s Digital Financial Inclusion Advocacy Hub.