Driving Women's Financial Inclusion at All Levels

Explore the latest global and regional insights from Women’s World Banking’s work in policy, leadership, women’s entrepreneurship, gender lens investing, and more.

Latest Posts

Making Finance Work for Women for 45 Years | Allen

To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking’s journey since its inception in 1979 at Commission on the Status of Women to today! These are stories from across Women’s World Banking’s reach from

The MFWW Podcast Ep. 14: Reimagining Finance: Women, AI, and the Future of Fintech

In Episode 14 of the Making Finance Work for Women podcast, we’re exploring the cutting edge of fintech, where innovation meets inclusion. We’ll unpack the gender gap among fintech founders, delve into how emerging technologies like AI are reshaping the industry, and tackle the crucial issues of privacy, trust, and financial health.

Making Finance Work for Women for 45 Years | Sarah Mwanthi

To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched the Women’s World Banking journey since its inception in 1979 at Commission on the Status of Women till today. These are stories from across Women’s World Banking’s

Digital Remittances Help Women Migrant Workers Take a Leap Forward, One Click at a Time

By Maria Serenade Sinurat, Ker Thao, Elwyn Panggabean A visit to Samut Prakan, an industrial zone located 30 kilometers from Bangkok, offers a glimpse into the lives of Cambodian migrant workers in Thailand. This town is one of Thailand’s economic zones that attract low-skilled, low-wage Cambodian migrants, particularly women, who

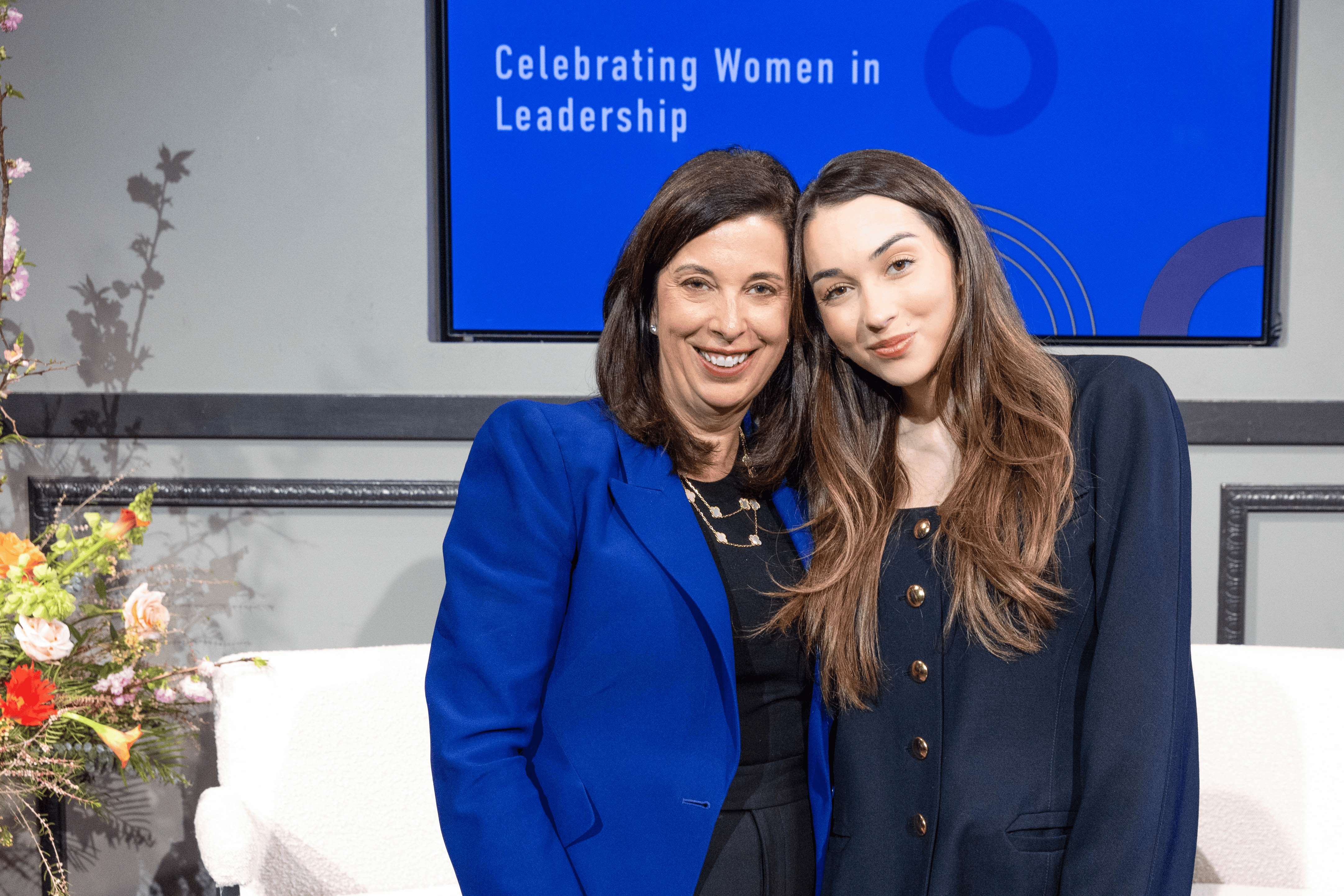

Making Finance Work for Women for 45 Years | Janet Truncale

In celebration of Women’s World Banking’s 45th anniversary, we are highlighting the voices of individuals from across the globe who have significantly contributed to and influenced the organization’s journey since its inception at the 1979 Commission on the Status of Women. Meet Janet Truncale. In a world where women’s empowerment

The MFWW Podcast Ep. 13: Making History – The $700M Fund for Women’s Financial Inclusion

In Episode 13 of the Making Finance Work for Women podcast, we explore the groundbreaking Global Gender-Smart Fund (GGSF) with Ruurd Brouwer, Board Chair of GGSF and CEO of TCX. Discover Ruurd’s journey into gender lens investing and learn about the innovative fund designed to achieve $700 million in assets

Inside Track: A New Era of Women Leaders Revolutionizing Tech Regulation

How Women’s World Banking’s new TechEquity Program for women policymakers, regulators, and supervisors is leveraging new research to tackle wicked industry problems By Sonja Kelly (Vice President, Research & Advocacy) and Elizabeth Ingerfield (Manager, Leadership & Diversity Programs) Tech jobs are not a tool for exclusion—they are a radical new

The MFWW Podcast Ep. 12: CBDCs Explained – The Rise, Risks and Future in Financial Inclusion

In Episode 12 of the Making Finance Work for Women podcast, we dive into the transformative potential of Central Bank Digital Currencies (CBDCs) and their implications for women worldwide. With over 120 CBDC pilots and projects currently in development, these digital currencies promise to revolutionize financial inclusion.

How to insure unqualified or uninterested customers? Ask insurance supervisors in Belize and Ghana

by Elizabeth Ingerfield, Manager, Leadership & Diversity Programs In a world of greater unpredictability and climate impacts, insurance can be a challenging product to deploy. Forward-thinking regulators, policymakers, and supervisors are changing their tactics, ensuring insurance can be a tool for inclusion. In a recent event bringing together alumni from

Empowering Nigerian Women Entrepreneurs through Digital Credit

Nigeria boasts a thriving community of women entrepreneurs. In fact, the country has the world’s highest proportion of activity by women entrepreneurs, comprising a remarkable 23 million women who command 41% of the country’s micro-businesses. Beyond the statistics, these women are the unsung heroes of resilience, contributing to their families