By Ker Thao, Maria Serenade, and Elwyn Panggabean

Globally, the emerging youth population presents a potential for economic growth. However, youth in developing countries also still face barriers to access financial services, such as three of 10 million Cambodian young adults who remain financially underserved.

Youth savings, in particular, has immense potential for improving a country’s gross savings rate, asset-building and instilling healthy financial habits in customers. At Women’s World Banking (WWB), we have seen time and again the social and financial returns for financial service providers that recognize this opportunity.

In Cambodia, WWB and AMK Microfinance Institution designed and piloted solutions to drive young adult customer engagement and savings, leveraging WWB’s women-centered design methodology. In this blog, we share five design principles that are effective in increasing product awareness, account acquisition and activation among Cambodian young adults (YA).

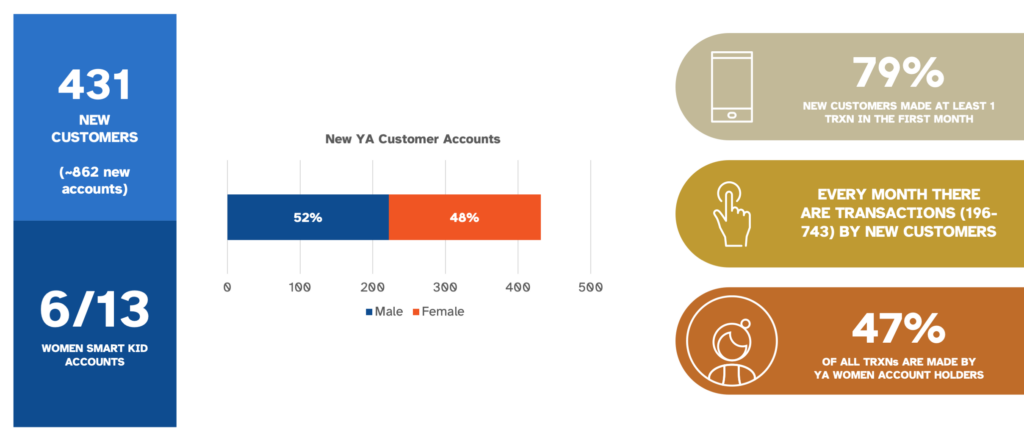

These five guiding principles led to 431 new YA customers (ages 18-35) between February-May 2023, with 79% of new customers making at least one transaction in the first month. Of these new customers, 48% (209) were female customers. With our methodology, we continue to see product adoption rates on average are the same for men and women, whereas without this methodology women customers tend to be left behind.

Pilot Results and Evaluation: Increased Awareness and Engagement

Our previous customer research has informed us that financial literacy and capabilities among low-income Cambodian young adults are low. However, there is a demand for increased digital literacy, accessible, and trustworthy digital financial services.

As a result of these learnings, we piloted our financial solutions between February-May 2023 and targeted non-student YA and YA University students between the ages of 18 and 35.

The overall pilot reached a total of 71,144 young adults through online (digital marketing via Facebook) and offline (on-site booth activation at universities) campaigns and engagement activities, of which 431 new customers opened an AMK account, with 79% of new customers making at least one transaction in the first month. Of these new customers, 48% (209) were female customers.

The Five Design Principles that Led to 431 New AMK Customers

Based on prior customer research, we created solution components that focused on raising customer awareness through campaigns, learn-by-doing approaches to build digital financial capabilities, and incentives to help build financial behaviors and motivate customers.

These components boiled down to five core design principles. With these principles, we seek to help financial service providers reach out to YA women customers and provide them with accessible digital financial solutions.

1. Increate overall visibility and brand

The overall pilot reached a total of 71,144 young adults through online (digital marketing) and offline (on-site booth activation at universities) campaigns and engagement activities, increasing brand awareness among YA, especially YA women. Leveraging channels that YA prefer and use, such as Facebook, YouTube, and Instagram, can help reach the right audience and help them make informed decisions on what financial products and services are available to them. Through the social media campaigns alone, we reached 35,958 women customers through static and video posts on Facebook.

2. Provide Clear value proposition

For financial institutions who have not served YA women segments previously, there is a need to re-position themselves to reach these customers. It requires communicating its benefits and values that speak to the potential younger customers. We took an active approach by setting up university booths to introduce AMK as a trustworthy financial provider, where YA students could learn more about AMK and about the savings account targeted towards them.

“I wanted to have a separate account for my savings. I also noticed that AMK gives Loyalty Points on top of a high interest rate. So, I think it is a good fit and applicable for students to save up.” – 24-year-old Kampung Cham Province female student

3. Ensure easy access and usability of digital accounts

YA tend to be more tech-savvy and often prefer to transact digitally. Ensuring an effortless and accessible transaction experience is considered a top-of-funnel goal. Our solution provided easy cash-in and cash-out points that helped customers fund their digital accounts and actively use, while also ensuring customers could retrieve their money when needed. This is crucial for student cashflow and needs, especially for school fees, supplies, and daily needs.

4. Learn-by-doing session

In-person support is proven effective in acquiring new customers. Other helpful tools are video tutorials to educate new customers about products, how to use them, and can promote healthy financial habits. Our solution provided both in-person learning sessions along with video tutorials available directly via the mobile banking application. We see that YA are more tech-savvy and often able to navigate and prefer learning by themselves. Providing accessible learning tutorials help aid in their curiosity to explore more digital use cases.

5. Build digital financial capabilities

Given the prevalence of digital banking, the solution helped YA women gain confidence in using mobile banking for top-ups and transfers. We used multiple channels to remind and motivate customers, such as Facebook posts and push-notifications conveying messages that are relevant to their needs to use their mobile banking app.

As core customer bases begin to age, as in AMK’s case, understanding the needs, challenges, and opportunities of serving YA, especially YA women customers, will be an important step to ensure that they are also financially included. While low-income YA women customers face similar challenges with digital and financial literacy and skills, our learnings and design principles provide a pathway towards creating sustainable products and strategies to reach, educate, and help young adult women customers use digital financial services and products. If financial service providers can provide financial services, such as savings, for YA before they reach adulthood, they can cultivate a new generation of financially included, informed and empowered customers who can better plan for and invest in their futures. On the business side, financial service providers have the opportunity to be the bank of choice for this customer over their lifetime.

This work has been made possible thanks to funding support from the Australian Government’s Department of Foreign Affairs and Trade (DFAT).