By Angela Ang and Elwyn Panggabean, Women’s World Banking

Last year, we collaborated with Bank Rakyat Indonesia (BRI), one of Indonesia’s largest state-owned banks involved in distributing benefits of the PKH (Program Keluarga Harapan or Family Hope Program), a conditional cash transfer program for low-income families. Together, we developed an account activation solution aimed at building the capabilities of women PKH recipients to actively use their bank accounts to grow their savings. From our pilot with BRI, we learned that:

- Low-income women, including government-to-person (G2P) beneficiaries, want to and do save; however, they need the right support and tools to help build a good savings habit.

- Low-income women still think they can only save large sums of money in bank accounts. By showing women they can save in small amounts, we can help shift their perspective on who can save at the bank.

As part of our pilot evaluation, we wanted to dig deeper to understand the key success factors to helping women customers save with their bank accounts. This blog aims to share these learnings and find additional ways to maximize the program’s impact on women’s financial inclusion in Indonesia and beyond.

Success factors in driving women’s savings habits

In our evaluation, we found that the combination of an account education and savings kit for women customers, the support of the PKH ecosystem, and socialization in group settings helps to encourage women customers to save within the formal financial system.

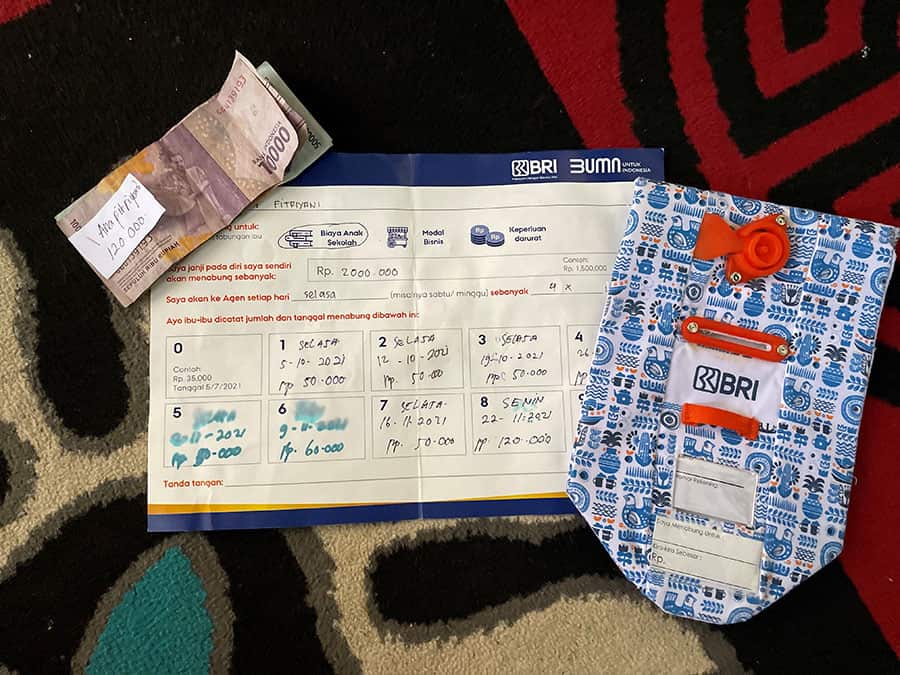

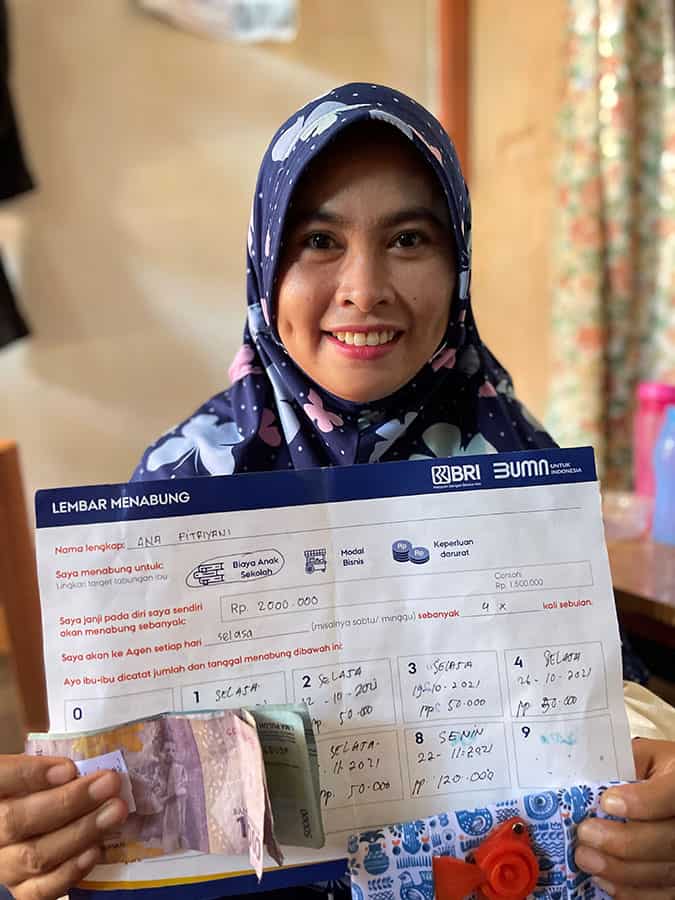

- Education + Educati and equipping them with the savings kit (comprised of the Savings Wallet and Savings Worksheet) was integral in helping them to develop regular savings habits. Through gamification, we rewarded women customers for reaching key milestones (i.e. learning about savings or saving for the first time in their wallet), thus encouraging them to save more and building their confidence.confidence.

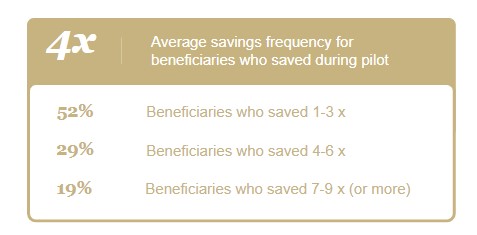

“I’m surprised that I could actually save IDR 1 million.” – Beneficiary in Panakukkang - People: The people within the PKH ecosystem also played a significant role in the success of the solution. PKH beneficiaries were organized into peer groups of approximately 25-35 women, which were led by a Peer Group Leader and also overseen by a PKH Facilitator. In our savings solution, the Facilitators and Peer Group Leaders were recruited as ambassadors of the savings program because they were seen as trusted touchpoints by their peers. This structure also formed the basis of the educational training program: PKH Facilitators educated Peer Group Leaders, who in turn educated beneficiaries.Other important stakeholders the savings solution included Agents, who conducted house visits to collect beneficiaries savings, and Social Assistance Officers (BRI Staff), who created Monitoring Sheets for Agents. Their contributions helped to build a strong and supportive ecosystem that encouraged women beneficiaries to actively save in their bank account, with 20% of all beneficiaries saving at least once a week.

- Savings as social activity: The third contributing success factor to our savings solution was the social aspect. In our evaluation, we learned that some beneficiaries would get together on their own each week to save at their Peer Group Leader’s home. During these social gatherings, women would motivate each other to save, compare savings amounts, and catch up with one other.During our mid-line evaluation, we spoke with a woman who had almost stopped saving twice but was then encouraged by her neighbor, another fellow program participant, to keep saving. This neighbor reminded her that she had two sources of income and a higher capacity to save than her. This story was a good example of how social influence within a community can help build savings behaviors and habits.

How do we achieve greater impact?

Having established the key success factors, how can we build on and maximize our solution’s impact?

Leveraging an existing ecosystem to develop a supportive environment for women plays a significant role in helping them actively save in their bank accounts. The support of Indonesia’s Ministry of Social Affairs (MoSA), which runs the PKH program, was especially critical in getting the PKH Facilitators to participate actively in and advocate for the program.

One challenge that remains throughout this program is having beneficiaries actively using their PKH Account for savings or other transaction might create a challenge in monitoring the PKH payment transaction data. It is imminent for the banks or G2P payment providers to find a solution that enables them to provide an accurate PKH related data to report to MOSA, and still allow beneficiaries to use their PKH account actively for their financial needs. This will instill confidence in MoSA to provide such transparent support for programs like this in the future.

Moreover, the Customer Lifetime Value (CLV) analysis suggests commercial viability of the solution, having the CLV nearly doubled (from IDR 1,400 to IDR 2,700) then the cost of the solution. This illustrates a business case for other PKH distributors to replicate the solution among other G2P beneficiaries and potentially with other relevant use cases beyond savings, such as bill payments, remittances, and microloans. Cross selling other use cases will not only improve the business case for PKH Distributors but also improve the beneficiaries’ prosperity and support MoSA’s plan to reduce poverty and progress graduation plan.

Lastly, in line with Indonesia’s G2P 4.0 vision, designing comprehensive customer journeys that not only include account education, but also a strategy to drive high engagement levels with the account, is critical to give the optimum benefits for the women beneficiaries and also the FSP providers.

Although our pilot with BRI has concluded, our efforts do not stop here. We hope that expanding and replicating this solution, both within and outside Indonesia, will create greater impact and help close the women’s financial inclusion gap.

Women’s World Banking’s work with BRI is supported by the Bill & Melinda Gates Foundation.