To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking journey since its inception in 1979 at Commission on the Status of Women to today!

These are stories from across Women’s World Banking’s reach from the women we serve and our customers, to allies and women in leadership who have contributed to women’s economic empowerment and financial inclusion.

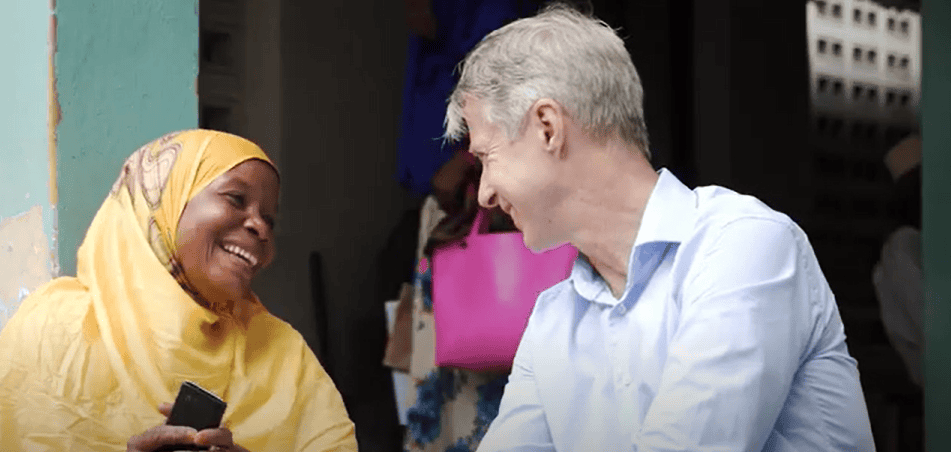

Meet Mats Granryd. He is Director General of the GSMA and has been a longstanding champion of women’s digital financial inclusion, particularly for underserved women across low- and middle-income countries (LMICs).

Through his work, Mats has seen firsthand how mobile technology has transformed the lives of millions across Asia and Africa including rural farmers like Fridah, from Kenya, who thanks to mobile internet has been better able to analyse weather patterns, tend to her crops, improve her agricultural yield and thus income. It is clear that mobile can help empower women, providing them with critical access to information and life-enhancing services including mobile money, often for the first time. This is especially true for people in LMICs, who primarily access the internet via mobile, and particularly for women and those in rural areas.

But Mats is also acutely aware that despite more people using and benefitting from mobile phones and the internet than ever before, there is a significant gender gap in mobile internet adoption across LMICs. In LMICs, 66% of women use mobile internet compared to 78% of men. This translates to 265 million fewer women than men using mobile internet.

Last year, the GSMA reported that progress in reducing the mobile internet gender gap had stalled for the second year in a row. But this year, according to their Mobile Gender Gap Report 2024 published in May, the gender gap in mobile internet adoption has begun to narrow slightly from 19% in 2022 to 15% in 2023 due to women adopting it at a faster rate than men. This means that women are now 15% less likely than men to use mobile internet in LMICs. Across LMICs there is also a gender gap in smartphone ownership (13%), mobile ownership overall (8%) and gender gap in mobile money adoption (28%).

So even though more people are connected to mobile phones and the internet now than ever before, women are still less likely than men to access and use them. This gap is not just slowing the progress of women’s digital inclusion, but hindering women’s financial inclusion overall.

For women entrepreneurs in these countries, where the World Bank estimates that self-employment is the source of livelihood for more than half (nearly 56%) of people, the mobile gender gap indicates untapped business-related digital capabilities and missed income generating opportunities. Additional Women’s World Banking research indicates that women entrepreneurs who do leverage mobile for e-commerce still use a smaller range of platforms than male entrepreneurs, highlighting that digital connectivity efforts must account for usage patterns between genders to be effective. Research from GSMA across 10 LMICs also indicates that women micro-entrepreneurs are less likely than men to use a mobile phone to support their business more generally, including lower use of digital financial services such as mobile money.

Digital and financial inclusion efforts need to be tailored to women’s unique needs, by placing women at the core of services and products strategies, as advocated for in the Women-Centered Design methodology and “Reaching 50 Million Women with Mobile: A Practical Guide.” In a recent interview with Teletimes International, Granryd noted barriers such as device affordability, a lack of literacy and digital skills, safety and security concerns, access, and a lack of relevant content in local languages, that need to be addressed to ensure that underserved women are able to reap the benefits of mobile connectivity.

Mats has also previously highlighted several initiatives by the GSMA that aim to address these barriers including the Connected Women Commitment Initiative whereby mobile operators are driving an effort, with support from the Connected Women team, to reduce the gender gap in mobile internet and mobile money services by making formal Commitments to increase the proportion of women in their mobile internet and/or mobile money service customer base. More than 50 mobile operators across Asia, Africa and Latin America have made commitments since 2016, collectively reaching over 70 million additional women with these services.

This initiative highlights that bold commitments with clear targets and actions that focus on the key barriers women face is making a difference. However, no one stakeholder can close the mobile internet gender gap on their own. Greater focus, investment and partnerships are needed from all stakeholders to accelerate digital and financial inclusion for women across LMICs

As illustrated by the GSMA’s and Women’s World Banking initiatives, as well as by efforts driven by other participants of our Women’s Digital Financial Inclusion Advocacy Hub, public and private sector collaboration is key for meaningful change. The potential benefits of increased mobile access for women, and therefore underserved communities at large, are significant. Research shows that use of mobile phones by women can lead to improved well-being and empowerment. For women micro-entrepreneurs, research across 10 countries showed that most report that they could not run their business without one or would find it more difficult to do so.

And, as Granyrd points out, “a connected society is a happy society, a society that thrives.”

In fact, once women start using mobile internet, this year’s Mobile Gender Gap Report notes, most women use it every day and report and overall positive impact on their lives. And, in increasingly digital yet fraught environments, access to mobile can also enhance the women’s resiliency in the face of economic, climate and political crises and shocks.

“The progress needs to be much sharper,” Granryd acknowledged in an interview with Women’s World Banking President and CEO, Mary Ellen Iskenderian. He emphasized that mobile can be a critical enabler for financial inclusion—such as accessing a bank account online or using mobile money. This is where partnerships between organizations like the GSMA and Women’s World Banking can complement one another well, and offer pathways for local financial services organization to better support women entrepreneurs and digital inclusion.

“We come with one part of the technology, you come with another part of it, and together we can actually make financial inclusion happen.”

Women’s World Banking has changed the lives of millions of women, transforming their households, businesses and communities, and driving inclusive growth globally through financial inclusion.

Today, using our sophisticated market and consumer research, we turn insights into real action to design and advocate for policy engagement, digital financial solutions (see Blanca’s story here), workplace leadership programs, and gender lens investing.

Help us reach the nearly billion women still excluded from the formal financial system. Donate now.