Cross-posted on BSR.

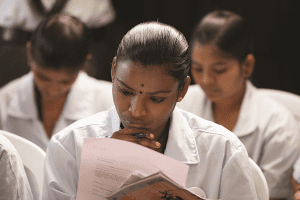

Since the launch of HERfinance, which was built with a founding grant from the Walt Disney Company, BSR has piloted this program in 11 factories in India, reaching 10,000 garment workers. Surveys of over 300 randomly chosen participants reveal that HERfinance has helped 92 percent of them increase their savings rates, with the average person saving 25 percent more each month.

And while virtually all of these workers have access to a bank account provided by their employer, only 56 percent of them used those accounts for savings. By the end of the HERfinance training, their use of these accounts increased by 39 percent, underscoring the need not only for the financial service but for the financial education.

The World Bank estimates that 2.5 billion people worldwide are excluded from the formal financial sector due to a variety of reasons: Many bank accounts require high minimum balances and charge excessive transaction fees or can be accessed only through ATMs or bank branches that are located too far away for people to get to them during business hours. For women, these barriers are even more acute due to security concerns or cultural norms that prevent them from using traditional banking services.

To address these structural challenges, this new collaboration will bring Women’s World Banking’s 35 years of experience building financial products for low-income women to the HERfinance programs, which focus on increasing workers’ awareness and skills. By researching how HERfinance participants are using financial services, Women’s World Banking will identify unmet needs and work with financial services partners to design products that support an inclusive financial system for the working poor. The aim is to bring more people into the formal banking system and give them the tools and awareness so that they can build better lives for themselves and their families. It will also ensure on-time salary payments, reduce fraud that occurs with cash payroll, and lower payroll administrative costs.

Women’s World Banking and BSR’s HERfinance are poised to close the loop for millions of low-income workers by offering an effective combination of financial education programs and relevant, affordable, and convenient financial products. These tools can help them save, invest in their families, pay their bills, and protect themselves during health emergencies and gaps in employment.