Latifah’s Story

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

Explore the latest global and regional insights from Women’s World Banking’s work in policy, leadership, women’s entrepreneurship, gender lens investing, and more.

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

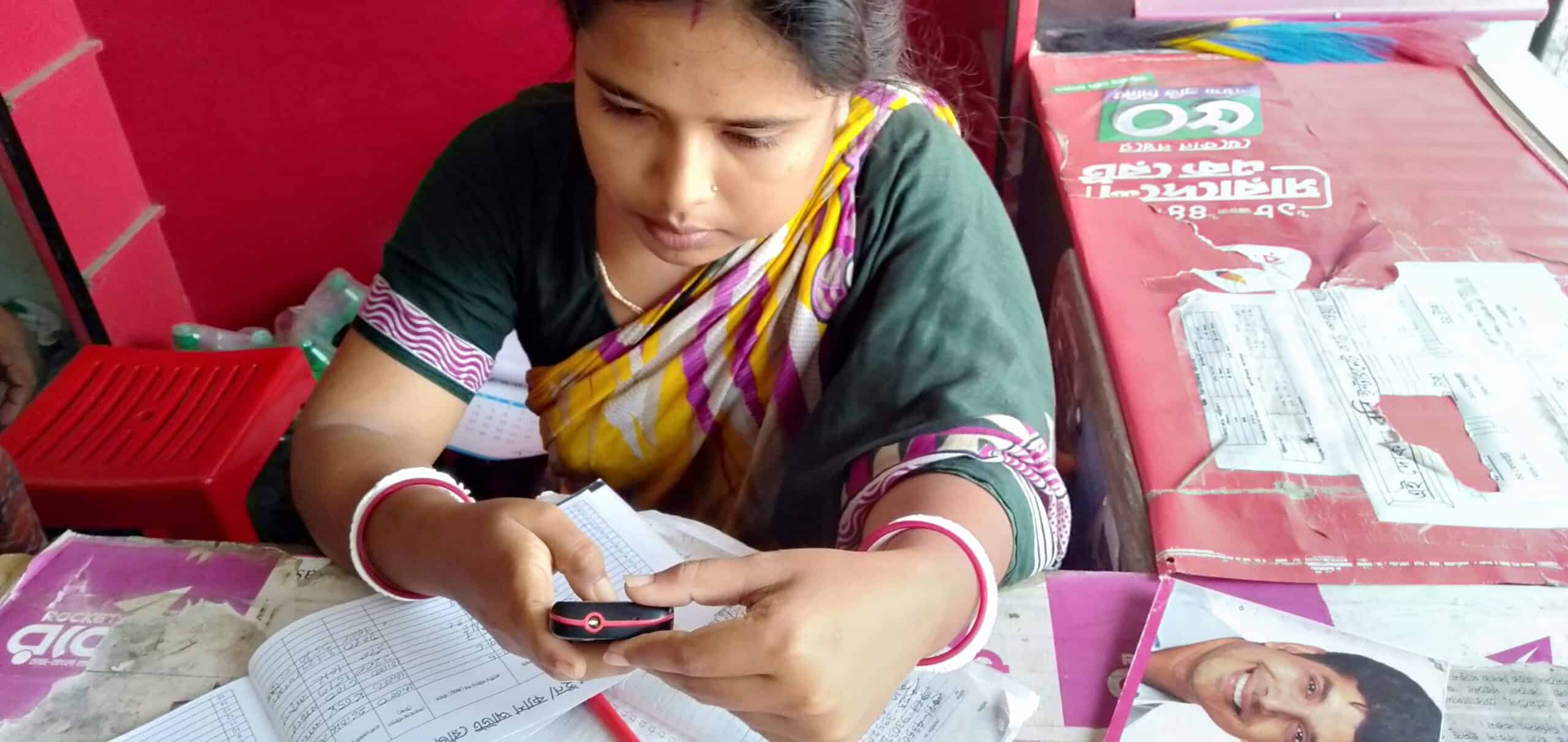

With a growing gender gap in financial inclusion in Bangladesh, it is imperative to understand the behavioral barriers women face when engaging with digital financial services.

India has experienced exponential growth and enacted innovative financial initiatives in recent years, but promising indicators of greater financial inclusion mask a concerning trend. About half of the women in India with personal bank accounts use them in a limited capacity or not at all. Women’s World Banking’s India Strategy

She Counts, a global platform that harnesses the power of financial services to put savings and financial tools in the hands of women, enabling them to plan for a more prosperous future.

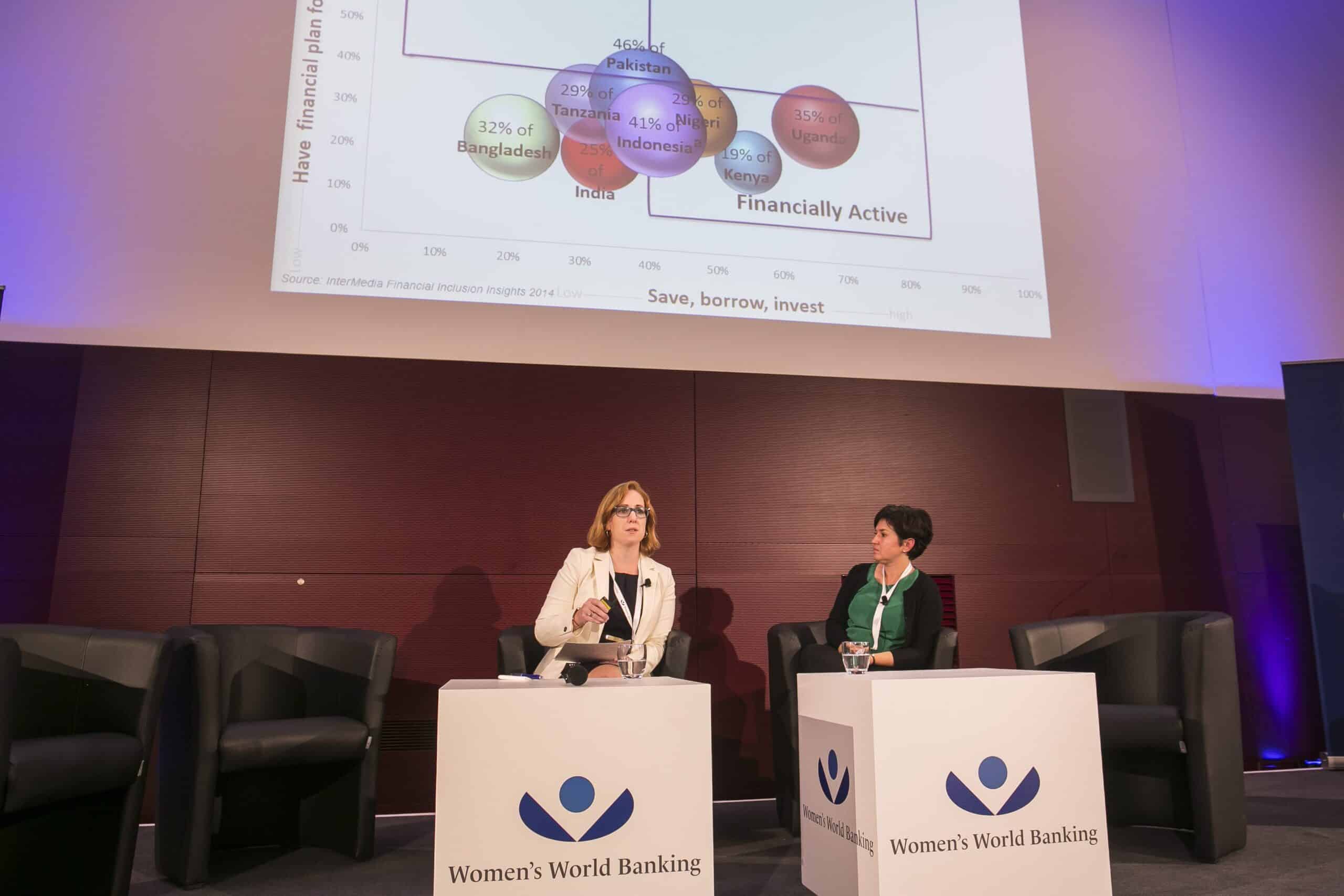

Women’s World Banking’s recent Making Finance Work for Women Summit brought together leaders from the public and private sectors, investors, and researchers to discuss, debate and create the solutions to drive women’s financial inclusion globally.

A room full of eager participants at Women’s World Banking’s Making Finance Work for Women summit in early November gathered for a deeper dive into the topic of gender lens investing.

Women’s World Banking undertook research to determine why women aren’t saving actively in a bank and tested prototypes to change that behavior.

Women’s World Banking’s strategy for closing the financial inclusion gender gap in Egypt targets the players and the solutions that will ensure women benefit from, and contribute to, Egypt’s potential for robust growth.

Women’s World Banking’s strategy for Bangladesh addresses why women are getting left out of the country’s financial inclusion gains, and sets out ambitious, workable solutions to shrink the gender gap.

Health insurance is complicated. It is full of financial jargon, and it can be confusing to understand even for those who can afford it and are paying premiums for it.

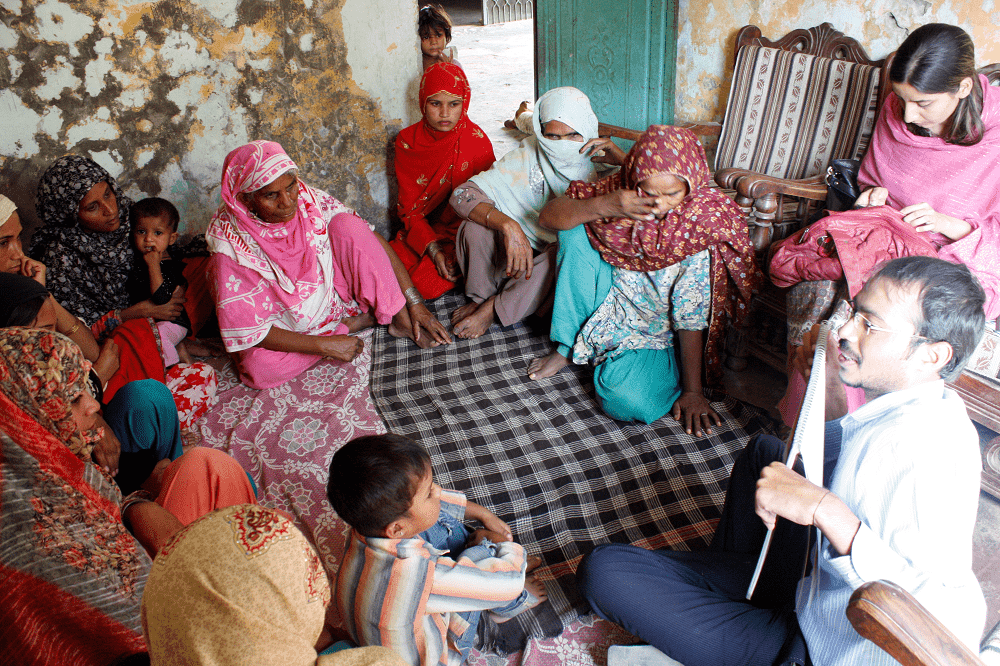

Women’s World Banking worked with Jazz to partner with Unilever’s women entrepreneur training program to leverage each companies core competencies to increase value for their products and drive financial inclusion for low-income women in Pakistan.

Policymakers have the opportunity to play game changer in driving women’s financial inclusion efforts. However, a strong, gender-diverse team within the regulatory body needs to be in place to amplify these efforts. Women’s World Banking and AFI’s Leadership & Diversity for Regulators program provides the tools to design inclusive policies

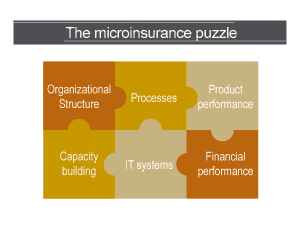

In order to serve the massive market of women-led enterprises, financial service providers must adopt women-centered model that often requires massive change throughout their operations.

Often, many financial services providers only superficially tailor their products in order to reach the women’s market. If f they are to reach this untapped segment, they must articulate a clear business case, avoid being “gender-neutral” and use gender segmentation during product design and to meet women’s needs.

Women, especially the low-income segment, are often overlooked by traditional financial service providers in Egypt. Women’s World Banking and Lead Foundation developed an innovative individual lending methodology that successfully reached women entrepreneurs.

Vietnam has millions of economically active women who interact with the formal financial sector at a superficial level. Women’s World Banking worked with Maritime Bank to develop a strategy to deepen its outreach the women’s market.

While Mexico has made great strides in driving financial inclusion for low-income women but many more barriers, albeit surmountable, need to be addressed before the country can realize the economic benefit of financial inclusion.

One year on, a look back at our CEO’s House Foreign Affairs Committee testimony on the importance of promoting women’s financial inclusion globally to unlock economic growth.

The Central Bank of Nigeria announced that the country would not be meeting its 2020 financial inclusion targets. Nevertheless, developments in biometric ID, regulatory sandbox, industry partnerships and agent network growth are on the horizon to put the country back on track.

A public service announcement concerning investments, fundraising and representation of our gender lens impact investment fund, Capital Partners.

Behavioral design is an important new tool in helping the financial services industry see women (and low-income women in particular) as a viable market segment.

Can microinsurance be meaningful for clients and sustainable for the provider? Our woman-centered, client-centric approach in Egypt shows it can.

With only a high school diploma and the work experience of harvesting in rice paddies, this woman microentrepreneur started growing her small idea into a diversified business.

Using our women-centered design approach, we worked with ideas42 to figure out how to get more women to sign up for JazzCash mobile accounts through referrals.

Women’s World Banking hosted a Twitter chat to hear from three organizations about how they’re helping women build a better future through digital savings while creating a more sustainable business.

This Mother’s Day, a look at how Women’s World Banking has developed financial tools and resources for mothers to build a more secure future for herself and her family.

La visita facilitó el intercambio de las mejores prácticas y lecciones aprendidas por Fundación delamujer a Lead Foundation, en las etapas de diseño e implementación de productos de crédito rural y microseguros.

Initial thoughts on what the data from the just-released Global Findex means for women’s financial inclusion around the world.

Four lessons on building inclusive value chains for the fast-moving consumer goods industry.

Perspectives from Unilever, the World Cocoa Foundation and Mastercard on ways to create a global supply chain that includes women.

How our gender lens impact investing fund Capital Partners delivered returns for gender equality for low-income women and gender diversity for the institutions that serve them.

Program supporter Credit Suisse reflects on the evolution of the Leadership and Diversity for Innovation program to better build diverse institutions.

FSDA guest blogs on their support for our partnership with Diamond Bank and the transformational effect access to a savings account has on women’s lives.

On International Women’s Day, read why Australia is committed to advancing gender equality by driving financial inclusion for women.

Women, especially in emerging markets, are expected to rely on their husbands for income. But what if their husband isn’t there anymore?

Emerging data from our projects in Nigeria and Pakistan counters bank leaders’ perception that women aren’t good bank clients.

What needs to happen in Bangladesh before digital financial services become the financial inclusion solution for women in the country?

A government opens a bank account for citizens receiving welfare payments. How can we turn recipients from “withdrawal-only” users to financially included?

Why blockchain can be a game changer for women’s financial inclusion, even in the village.

Investors can use a gender lens to deploy capital that advances a social good—gender equality—and earning a financial return simultaneously.

Digital financial services has, in just the past ten years, changed the landscape of financial inclusion. But has it done much for women?

Players, new and old, are beginning to recognize their critical and interconnected roles in advancing women’s financial inclusion.

Make serving the women’s market the New Year’s Resolution that drives your institution’s double bottom-line.

We feature the closing conversation of the Making Finance Work for Women Summit, which looks ahead to the future for women’s financial inclusion.

Enabling regulation and competition in Mozambique’s digital finance market bodes well for financial inclusion. Women must be a part of that revolution.

What our digital financial services peer exchange participants learned about defining the problem from behavioral design firm ideas42.

How a payments giant, tech giant, “alternative” lending disruptor and “alternative” electricity provider use FinTech to serve the low-income market.

Three takeaways from the Making Finance Work for Women Summit.

What the Alliance for Financial Inclusion’s Global Policy Forum says about progress towards women’s financial inclusion on the national level.

Essential considerations for successful youth banking propositions that increase youth’s economic opportunity and offer a valuable business case to banks.

One year on, what has the effect of demonetization on India been? Thoughts from our Chief Investment Officer.

The incredible potential for impact when working with a government that understands the importance of women’s financial inclusion & puts resources behind it.

This year’s SME Finance Forum will include interactive sessions, study tours to high-performing institutions, fintech demos, a B2B marketplace & networking sessions.

Part two of a series on the opportunity for factories to offer financial and non-financial services to drive deeper financial inclusion.

80% of India’s 6 million garment employees are women. Many are not formally banked. These factories can be these women’s gateway to financial inclusion.

With every loan from Negros Women for Tomorrow Foundation, Shirley was able to grow and expand her business from an informal market stall to a buzzing, formal operation.

Our Product Development director explains the crucial elements of design to ensure financial product that works for women.

New regulation has inspired a renaissance for mobile money in Morocco. But competition is tight. How can a new player win in this market?

The next installment in the blog series, Meet the Women’s World Banking team: an interview with one of our newest team members, Diana Boncheva Gooley.

A new case study on our work with NBS Bank designing a digital savings account that addresses the barriers to banking facing low-income women in rural Malawi.

Parveen took her family from the brink of poverty to business success with her microentrepreneur’s spirit and the support of Kashf Foundation.

The success of women-focused products depends on front-line staff resonating with the objective to serve women as much as it does having leaders’ buy-in.

Women’s World Banking developed a profile of India’s low-income women to inform our approach designing inclusive digital financial services.

The comprehensive leadership training program we delivered for NBS Bank reinforced the institutional “must-haves” for programs to have a long-term impact.

Our President and CEO testified in front of the US House Committee on Foreign Affairs hearing, “Beyond Microfinance: Empowering Women in the Developing World.”

Financial services providers in Pakistan risk losing out on an untapped market opportunity by continuing to believe myths about serving the women’s market.

How has Women’s World Banking impacted the lives of low-income women around the world? Find out in our annual report.

Women’s World Banking tested an innovative social communications strategy: using a popular TV show to help change social attitudes about women and banking.

Supported by FSD Africa, we uncovered the must-haves for any financial service provider looking to give women-owned SMEs with access to credit.

Select excerpts from our comprehensive publication on inclusive health microinsurance products offer an overview of our approach to design and delivery of insurance that works for women.

Our new research approach looks at forces at work in women’s lives, allowing us to develop more impactful financial solutions. Take the case of India.

Women’s World Banking used data analysis to counter sales agents’ unconscious biases that were keeping women from accessing financial services.

Giving low-income women like Rathnamma access to a business microloan allows her to work for herself and make a better life for her family.

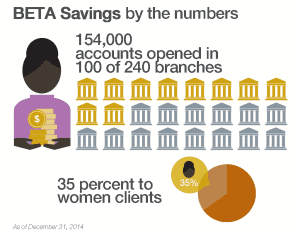

Diamond Bank (Nigeria) added more options to the BETA Savings mobile app but clients weren’t using them. How user experience testing solved this mystery.

Our microinsurance specialist shares best practices in sales training for microinsurance to ensure maximum outreach and uptake for low-income women.

Google Doodle made Women’s World Banking co-founder Esther Ocloo famous on April 18, 2017. What part did she play in our story?

A roundtable on how those in the business of financial inclusion can and should proceed to ensure women are part of the digital future.

Agency banking is one of the most promising that can overcome women’s obstacles to financial access.

Our Management Development Program at NBS Bank (Malawi) helped managers understand their core values and leverage their differences to better work together to serve women.

Supported by Negros Women for Tomorrow Foundation, Catalina built a fried chicken business that supports her family and lets her give back to the community.

We’re working with Diamond Bank and MTN to leverage big data in improving women’s access to digital financial inclusion. It is not without its challenges.

You’ve read a dozen stories of women who have empowered themselves through financial inclusion. What about a story about one who has not?

We sought to examine the current state of gender-diverse leadership around the world to see just how far the needle has moved and what remains to be done.

While microinsurance appears to be moving into the mainstream, it’s focus on client-centricity make success a trickier proposition.

Last year, I was invited to be a part of the Business & Sustainable Development Commission which brings together leaders from business, finance, civil society, labor, and international organizations to develop a private sector response to the challenges presented by the Global Goals. Specifically, the Commission has the “twin aims

A bank and regulator share how they were able to partner effectively to bring digital financial services to low-income rural women in Malawi.

Using Martha Chen’s Empowerment Framework, we evaluated whether our leadership training for low-income women had empowerment effects to their lives.

Meet Siddika, a tailor of bespoke and ready-to-wear clothes in Dhaka City, Bangladesh. Read her story of empowerment through financial inclusion.

Leadership & Diversity for Innovation Program alumni share how supportive training helped them become transformational women leaders in their institutions.

How can a world leader in gender equality have trouble closing the gender gap in financial inclusion? What we found in Rwanda.

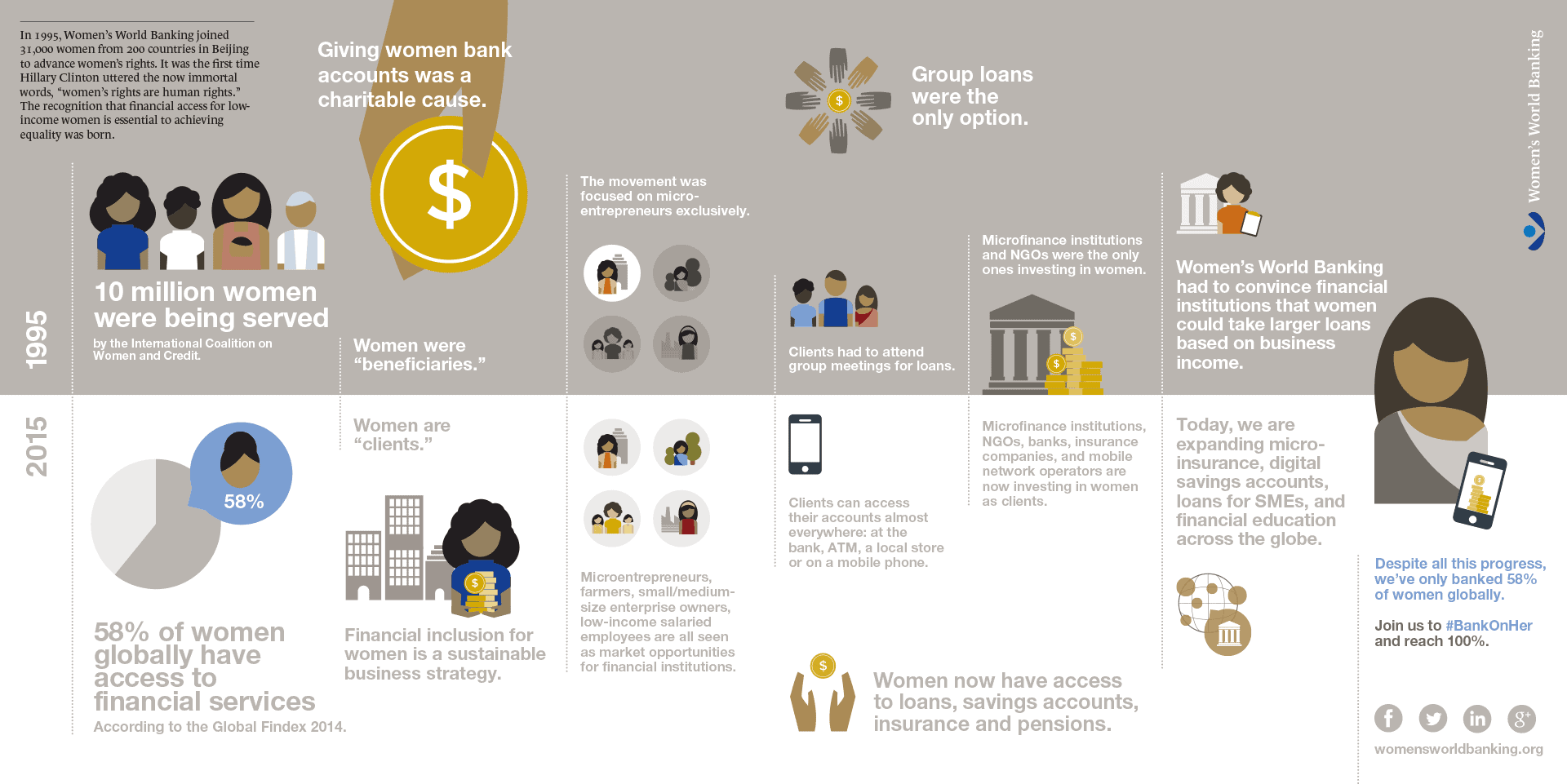

Our President and CEO reflects on what has changed and what has stayed the same since she took the helm of Women’s World Banking in 2006.

Read the story of Nirvana Ademović, a dough production entrepreneur from Gradačac, Bosnia and client of our network member MI-BOSPO.

Despite all the evidence that women leaders are good for business, what keeps more women from reaching the top tiers of their organizations?

Gender diversity is driving strong financial performance in many institutions. What can impact investors do to address what impedes achieving the double bottom-line?

Introducing our newest publication where we outline our research-driven approach to developing inclusive health microinsurance products in varied markets.

Our team applied user experience testing to optimize mobile banking services for low-income women in Nigeria.

An interview with the Head of Financial Inclusion at Diamond Bank (Nigeria) on the bank’s push to serving the unbanked, especially low-income women.

The rise of Southeast Asian economies have not escaped the world’s attention. We’re making sure women are included in the growth of the region.

Women’s World Banking staff attended the most recent Leadership Conference, hosted by The Wharton School of Business. What were the lessons they took home?

Meet Haifaa, a successful microentrepreneur in Lebanon and client of our network member in Lebanon, Al Majmoua.

Women’s World Banking added several new faces to the team this year, making us better able to empower low-income women with financial services.

Women’s World Banking went to Lagos to join Diamond Bank in launching their agency banking model for Nigeria’s un- and underbanked population.

In this guest post, Sutapa Banerjee argues that India’s new law reinforces gender bias in the workforce more than it counteracts it.

The pilot assessment of our project in Mexico revealed the keys to successful delivery individual lending for women-owned micro, small and medium enterprises.

Women’s World Banking outlines specific recommendations for public and private sector players to address the challenges to women’s financial inclusion.

How firsthand experience with our clients and partners is helping Women’s World Banking’s fundraisers accurately and authentically communicate our work.

A microfinance client success story from our network member in Lebanon, Al Majmoua.

Our team trained staff at two partner institutions on our research methodology, building their capacity to gather and use insights to better serve women.

Knowledge and Communications Associate Ashleigh DeLuca blogs about how we “refreshed” our storytelling to better communicate the value of serving women.

Our Chief Knowledge and Communications Officer reflects on the shift in how regulators are regarding advancing financial inclusion in their countries.

While savings groups satisfy some of low-income Malawians’ financial needs, they could really benefit from a private, individual savings account.

Our President and CEO comments on the UK Treasury’s “Women In Finance Charter” and what it represents in the move to increase gender diversity in the leadership ranks of financial institutions.

Findings and experiences on advancing gender diversity in corporate leadership from Women’s World Banking, Bloomberg’s Gender Equality Index and Deutsche Bank.

How can women-focused financial institutions mitigate the challenges in keeping their outreach to women when expanding to individual lending?

Despite huge efforts dedicated to advancing women in leadership across all industries, gender parity still has a long way to go. What’s missing is culture.

Our President and CEO is proud to introduce our digital annual report for 2015.

Microfund for Women is a pioneering financial institution in the Middle East serving women clients and promoting women’s employment and leadership.

Dendev’s tailoring business hit a familiar trap: she needs money to grow her business and she needs to grow her business to make money. Enter Xacbank.

Training financial inclusion-focused companies over the years has taught us that most technical challenges are actually management and leadership challenges.

We recently welcomed a new research director to our team, Erin McDonald. Associate Ashleigh DeLuca talks to her about her passion for data and more.

Women’s World Banking gathered partners in Jordan to discuss, debate and learn about microinsurance best practices.

Liz Kellison of the Bill & Melinda Gates Foundation reflects on visiting women clients in the Lagos markets during the launch event for Diamond Y’ello.

Women’s World Banking Capital Partners investee shattered records in India’s financial stockmarket during its IPO. The role our focus on gender played in this story.

Without a thoughtfully designed and well-executed sales training for your staff before roll-out, your innovative new product will go nowhere.

Women’s World Banking studied the staff composition and hiring practices of banks in Southeast Asia to find how to best promote diversity in the labor force.

During a recent visit to New York, Viji Das chatted briefly about her work and shared stories of the low-income women she meets in the field.

How did Al Majmoua achieve impressive gender diversity numbers–more than half the staff are female and 60% of senior leaders are women–in a challenging environment?

A mother abandoned by her husband with four children to raise all on her own. An unlikely candidate for Microentrepreneur of the Year.

As more financial institutions offer savings accounts for women, we updated our Gender Performance Indicators to ensure that women are still served well.

Two financial institutions in the Middle East are succeeding in advancing gender diversity within their institutions, How they’re doing it.

We conducted a Management Development Program at Ujjivan (India) to support their leaders through the institution’s transformation into a small finance bank.

Our Women in Leadership program was only for women leaders in financial institutions. This visionary leader thought her low-income clients should get it too.

Read the microfinance client success story of Suzan, a client of our network member in Lebanon, Al Majmoua.

Maura Hart, Manager, Knowledge and Communications, guest blogged on Ericsson’s Mobile Financial Services blog in honor of International Women’s Day.

We condensed our model of helping financial institutions begin offering individual loans to low-income women entrepreneurs into a handy guide.

Amy Herman shares how to use art to enhance observation and promote articulation to participants of the Making Finance Work for Women Summit.

Experts from the nonprofit sector and financial institutions to discuss the role of pensions in the field of financial inclusion.

The women’s microinsurance market is a trillion dollar opportunity for insurers. Experts on how to tap this market while ensuring meaningful value for clients.

Financial inclusion for low-income women has for years meant group loans. Three financial institutions on why the tide is shifting towards individual loans.

There are 10 million women-owned SMEs globally, 30% of the total. 70% are un- or underbanked, presenting a $300 billion market opportunity.

Providing savings for low-income segments is a valuable opportunity for commercial banks. Three CEOs share how they made the strategic decision to serve this market.

Experts from the impact investment community discuss the challenges to women-focused investing.

Women are a critical part of any business’ growth strategy. Experts from the consumer product industry share how they market to them it better than anyone.

Mazen Nimri of Jordan Insurance Company shares what it’s like to develop insurance for low-income people, from the insurer’s perspective.

Experts on the value proposition for multinational companies investing in women in the global supply chain and share examples of successful initiatives.

Kashf Foundation’s research team blogs about their findings from an impact assessment report of their services in 2015.

The pilot assessment of the BETA Target Savers revealed the challenges of reaching women, even with the help of digital financial services.

Using data to inform policy, strategy and product design will enable financial inclusion stakeholders to more effectively serve women.

Leora Klapper (World Bank) and Neli Espiova (Gallup Word Poll) share new ways of looking at financial inclusion data that reveal real insight on women, money and well-being.

The promise of women’s financial inclusion through technology has not yet been fulfilled. Experts on why, and how we can fix it.

Technology has accelerated financial inclusion to exponential levels while undoing and remaking long-standing industries. A focus on women too, is at risk.

A collection of stories highlighting the women leaders who blazed the trail for women’s financial inclusion globally.

Viji Das is an unstoppable force for the financial inclusion of low-income women in India. A profile of her life and work.

A profile of one of Colombia’s pre-eminent and pioneering microfinance institutions dedicated to women’s financial inclusion.

The next installment in the blog series, Meet the Women’s World Banking team: an interview with one of our newest team members, Rachel Field.

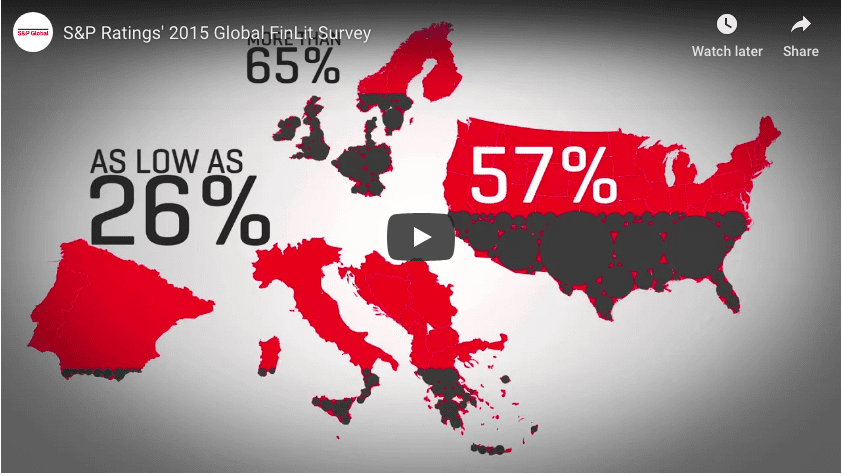

Our research specialist blogs about the recent McGraw-Hill study on the financial literacy gender gap and how we’ve been addressing it with our partners.

The next installment in the blog series, Meet the Women’s World Banking team: an interview with one of our newest team members, Carlos Hornillos.

Our research on the health needs and behaviors of low-income men and women in Egypt found many barriers—cost, priorities—as barriers to accessing healthcare.

Highlights and key takeaways from our recently concluded Making Finance Work for Women Summit in Berlin.

Our “visioning” exercise gives high-potential women leaders the time and opportunity to think, plan and grow into strong leaders in financial inclusion.

Maintaining a bank account adds another level of complexity to managing your hard-earned cash, a complexity that people who are barely getting by have neither the time nor resources to address.

Our Leadership and Diversity for Innovation Program concluded with a series of events in India that corporate America can learn from to enhance their own corporate diversity.

The poor are vulnerable to risk, a cause of persistent poverty. Microinsurance is one solution to mitigate risk, yet demand remains disappointingly low. This article looks at lessons learned and selective recommendations for increasing demand, based on academic studies and the experiences of over 60 innovation partners of the ILO’s Impact Insurance Facility.

Women’s World Banking conducted research on low-income women at risk for domestic violence in Colombia to see whether savings can bring physical, emotional and psychological well-being, as well as financial security.

A profile of Frances Sinha, co-founder of one of the largest social enterprises in India, Economic Development Associates, on her life’s work in financial inclusion.

Kashf Foundation guestblogs on their approach to client-centricity: a singular focus on clients’ needs and welfare, powered by research and client feedback.

The next installment in the blog series, Meet the Women’s World Banking team: an interview with one of our newest team members, Shilpi Shastri.

New research on women-owned SMEs in Southeast Asia, their barriers to accessing finance and recommendations for stakeholders to overcome barriers and enable access.

A summary of the chat hosted by Women’s World Banking, featuring The Clinton Foundation’s No Ceilings and UN Women’s Empower Women in honor of the 20th anniversary of the Beijing Declaration and Platform for Action.

A photo essay of the Fourth World Conference on Women in Beijing, 1995 where Women’s World Banking worked with advocates like Ela Bhatt, Muhammad Yunus to advance women’s economic empowerment.

Highlights from Eyad Nino’s (Microfund for Women, Jordan) “Ask Me Anything” on Women’s World Banking’s exclusive online Leadership Community.

Low-income women are diligent savers but often face tremendous barriers to saving safely with a bank. Digital savings can be a game-changing opportunity to introduce women to savings accounts and enable their financial inclusion.

The next installment in the blog series, Meet the Women’s World Banking team: an interview with one of our newest team members, Kate Glynn-Broderick.

Meet a client of Al Majmoua (Lebanon), Jamila. The financial and non-financial services she has received from the institution has helped her become a self-sufficient businessowner.

Women’s World Banking Fellow Sandy Salama profiles head of our Tunisia network member, Enda inter-arabe, from her early history in journalism to a prominent financial inclusion advocate for women.

The pilot evaluation of our youth savings project in India reveals the structural barriers women and girls face when accessing financial services. Could youth savings help?

On insights from a perception expert, a high school principal and an underdog researcher on our work developing gender diverse leadership in financial institutions.

Thoughts on recent attempts by US financial advisors to tailor messaging so they better appeal to women–something Women’s World Banking has known for years.

Shahida Pervin, Deputy Director of Shakti Foundation for Disadvantaged Women in Bangladesh interviews the founder of the organization, Humaira Islam.

The Global Meeting is an opportunity for the head of an organization and a high-potential leader. The high-potential leader should be already occupying a leadership role within the organization and reporting directly to the CEO.

Women’s World Banking is known for the in-depth customer research that precedes all our product development work. Our new insurance director witnesses this first hand during his first trip to the field.

There are millions of low-income people without access to formal financial services who have the opportunity of doing so through their work at factories. How can workplace-based training can accelerate financial inclusion for this population?

What do a typhoon and a refugee crisis have in common?

Deprived of an education, Kalpana parlayed her disappointment into a lucrative business as a pattachitra painter, with help from Ujjivan.

Women’s World Banking worked with Diamond Bank to design a loan that uses clients savings behavior to help them get access to credit quickly and easily.

What did the 14 leaders from women-focused financial institutions from around the world learn at the kick-off forum of the Leadership and Diversity for Innovation program?

Women’s World Banking support Diamond Bank (Nigeria) in developing savings accounts to meet the needs of low-income youth.

Millions of low-income salaried workers have a gateway to more financial services: direct deposit through their factory job. How do we ensure access leads to usage?

A story of success in giving low-income women access to credit to start a business: Monowara lacked skills and education, but she wanted to help her family.

Shini Ashok of Ujjivan interviews Dr. Medha Purao Samant, a widely acclaimed livelihood practitioner and pioneer in bringing microfinance to the slums of Mumbai and Pune.

When crisis strikes, whether it is the result of a natural disaster or political unrest, what can financial institutions that serve low-income clients do to support their clients and the community?

Our new microinsurance director blogs about his shift from managing risk in corporate insurance to developing meaningful insurance for low-income women.

Our goal is to remind our allies and supporters that financial inclusion must include the one billion women that don’t have access to basic financial products and services. The current interventions are working, but mostly for men.

Research Specialist Jaclyn Berfond blogs about Women’s World Banking’s new research agenda, going beyond product studies to exploring new markets, segments and services.

Leadership and Diversity Specialist Sarah Buitoni introduces our one-of-a-kind leadership program for senior leaders of financial institutions dedicated to serving the low-income market.

Martina Quirino narrates the story behind the founding of Negros Women for Tomorrow Foundation, Inc (Philippines) and the women leaders behind our network member institution.

Manager of Knowledge and Communications Julie Slama blogs about a recent trip to Ghana with Credit Suisse volunteers to understand the local microfinance market.

Head of consumer business at NBS Bank (Malawi) shares his key takeaways from an agency banking training in Tanzania led by Women’s World Banking and Helix Institute.

In January 2015, Women’s World Banking moved from our longtime home in Bryant Park to a new office space. Our Chief Operating Officer shares how he led the organization through the big move.

Anjali Banthia interviews Shorebank co-founder and Women’s World Banking board of trustee Mary Houghton on her work with Women’s World Banking and what it takes to be a good leader.

Throughout March you’ll see videos of our amazing network members, partners and advocates talking about how they’re making it happen for women around the world, in honor of International Women’s Day and more.

Volunteer Melisa Nunez reviews the recent webinar Women’s World Banking hosted on best practices in marketing microinsurance based on extensive research and application of these insights.

Developing a meaningful insurance product for Finance Trust Bank’s low-income clients was not enough. We needed to develop an educational marketing campaign to help their clients understand (and make use of!) the TrustCare product.

A profile of the CEO of Kenya Women Holding and strong advocate for women’s financial inclusion.

Women’s World Banking and NBS Bank (Malawi) toured TEB (Turkey), a best practice bank serving SMEs to learn from its approach and innovations in serving this segment.

Piloting new products requires constant monitoring to ensure success. In this post, we share how we adjusted our youth savings strategy to mitigate the challenges our project in India faced.

Women’s World Banking CFO Michael Mohr meets rural women clients in Colombia and doffs his finance cap to understand risk and success in micro-agribusiness.

For individuals, the new year is typically the time to make resolutions and vow to practice new, better habits. For businesses, the new year might be a good time to look for new opportunity.

Nithya Palanisami of Ujjivan Financial Services (India) shares her exclusive interview with Vinatha Reddy, founder of GrameenKoota, in this guest post.

Women’s World Banking has worked in several countries to develop innovative methods like soap operas to reach low-income women with financial education.

Associate Susan Gao lists the top themes that emerged in a recent conference on empowering women in agribusiness.

One of the key takeaways from our recent workshop on serving rural women is the importance of partnerships in providing for all the business needs of this market.

Women’s World Banking convened institutions and organizations invested in serving rural women to discuss the successes and challenges of developing an innovative, responsible, and sustainable approach to serving clients in rural areas.

Women’s World Banking CEO Mary Ellen Iskenderian weighs in on The Economist’s Nov 14 feature on financial inclusion to ask, “what about women?”

Women’s World Banking co-hosted a roundtable with financial inclusion players in Mexico to the challenges to offering individual lending in the country and a path forward to begin.

Women’s World Banking helped network member institutions in Latin America develop loans that meet rural women’s needs and deepen inclusion for the rural market.

After investing her savings into a business that failed, Nang Edjing picked up the pieces and started another venture with the help of NWTF.

Ujjivan’s Chandralekha Chaudhari profiles the accomplishments of one of the women who helped Muhammad Yunus found Grameen Bank in Bangladesh.

By MI-BOSPO Before the Bosnian war, Mirjana Parhomov was a safety engineer living quietly in the town of Bijeljina, Bosnia. During the war’s aftermath however, she was one of many who were left without a job, an income and a home. “It”s hard when you are left without a home

Mexico is one of the most populous countries in Latin America so it is not surprising that they have one of the largest number of microfinance clients: a whopping six million borrowers which is roughly 5% of the population (2013). Yet there is something distinct about how microfinance has developed

Mary Ellen Iskenderian discusses the prevalence of financial access inequality between genders for the Trust Women Conference.

Our Leadership Community members share best practices on what institutions and women themselves can do to promote greater gender equity.

An interview with the Managing Director of ACCION’s Center for Financial Inclusion by guest blogger Surabhi Shahi.

The financial education industry as a whole has stopped short in examining who or what kind of individual is most successful in delivering financial education. We share our experience of three different educator profiles in various projects around the world.

After launching our leadership and diversity program offerings in 2009, Women’s World Banking set out to study how leadership trainings can best translate into bigger and more sustained changes at the institutional level. We asked ourselves: what aspects of our program design most effectively drove this kind of change?

Low-income want to save, can save and need a safe place to save. While creating savings programs for the poor is not easy, we firmly believe that serving women makes business sense. Neither women nor banks can afford to miss this opportunity.

Guest bloggers Prerna Padwal and Praneeta Kanchinadam tell the story of Roshaneh Zafar, founder and executive director of Pakistan network member Kashf Foundation.

Parveen took her family from the brink of poverty to business success with her microentrepreneur’s spirit and the support of Kashf Foundation.

Read the story of Rani, a livestock and dairy business owner and one of Kashf Foundation’s (Pakistan) successful clients.

Guest blogger Jisha Francis tells the story of the incredible visionary for women’s rights, Elaben Bhatt, founder of Women’s World Banking network member in India, SEWA Bank.

Ujjivan (India) leaders visit fellow network member Fundación delamujer (Colombia) to learn individual lending best practices.

Women’s World Banking staff members share reflections on the lessons they learned from attending this year’s Wharton Leadership Conference, “Preparing for a Complex and Uncertain World.”

This is the story of Bahiya, a client of Women’s World Banking network member in Lebanon, Al Majmoua.

Fellow Ines shares the lessons she took home with her from a week with the Women in Leadership Program in Mexico, supported by MetLife.

The volunteers were in Bolivia as part of DB’s Corporate Community Partnership (CCP) Program, a volunteer program aimed at providing employees an opportunity to use their skills to support a DB partner organization in a meaningful way. Given Women’s World Banking’s long relationship with DB, we were honored to facilitate Pedro, Costina and Katharina’s engagement with FUNBODEM. This is the eighth time over the last six years that DB employees have volunteers to work work with a Women’s World Banking Network member.

Women’s World Banking has conducted more than a dozen Women in Leadership training programs around the world and each workshop manages to surprise and move us in different ways. This is the story of Mexico.

Mobile money is gaining momentum in Tanzania. Would other financial services be able to catch up? Women’s World Banking visited Tanzania in October 2013 to conduct industry and customer research to understand what opportunities exist for mobile banking in Tanzania.

Floods that hit Bosnia and Herzegovina last week inflicted enormous material damage to citizens. The real damage will not be known for a long time. MI-BOSPO launched emergency actions to assist its clients and employees. We have been collecting information on how many clients have lost their homes and property, in order for us to try to find ways to assist them.

With support from Agence Française de Développement, Women’s World Banking went to Morocco in March of this year to meet with rural and urban clients of the institution to help AlAmana solve the mystery of why clients weren’t using their microinsurance.

“How much did you spend on healthcare last time you were hospitalized?” That was the question Women’s World Banking’s research team posed to more than 70 participants of focus groups organized in Uganda early this year as part of our project to introduce a health microinsurance product with our local network member. The question seems straightforward enough, a simple matter of sums. As we found however, most of the participants were not aware of the full cost of their hospitalization and even severely underestimated it.

Finance Trust Bank and Women’s World Banking are working together to develop and offer a health microinsurance product to help alleviate the financial burden of major illness for their low-income clients. We began our product development work as all Women’s World Banking projects do: with in-depth market research. Specifically in Uganda, we needed to understand the usage, needs, financing and costs for healthcare among low-income people, as well as their awareness of insurance.

Savings Specialist Ryan Newton blogged about our youth savings project in India with SEWA Bank for the Huffington Post/ Cisco ImpactX blog.

Summer intern Melisa had the opportunity to interview Chief Strategy Officer Harsha Thadhani soon after the Women’s World Banking Board approved the organization’s next strategy. They talked about Harsha’s work and Women’s World Banking’s approach to strategic planning.

Besides the extent of their outreach and their ability to offer diverse products, an MFI’s success is now being measured by operational, financial, social, and gender indicators. In February 2014, Women’s World Banking’s Leadership and Gender Diversity program team provided Crecer, Crédito con Educación Rural in Bolivia just this opportunity to strengthen its team of managers through the Management Development Training program.

When I tell people that I work at Women’s World Banking, I often get a curious look followed by strings of questions: “Is it a bank for women?” “Is it a CIA front?”, or my favorite, “Can I get a loan from you?” The truth is, besides reciting the standard

We sat with Yolanda and Antonio on plastic chairs under a thatched roof hanging over the front of their house. They had lived on the same 5.5 acre land in Peru for decades and raised two boys by selling milk from their three cows, crops like tomatoes, paprika and corn,

In the MENA region, 18 percent of adults have an account at a formal financial institute compared to 42 percent in the rest of the developing world (Global Findex). The question “What does financial inclusion in MENA look like?” is an urgent one.

Fellow Ramatolie reflects on her experiences participating in the Women in Leadership Program held in Mumbai last November.

It is a rare sight to see a group of women leaders come together to spend a week reflecting on their lives, professions and leadership impact. Yet this is exactly what a group of high-potential women leaders and managers did in Mumbai, India last November to build their skills, confidence

Because International Women’s Day, March 8th, fell on a Saturday this year, we decided to dedicate our Twitter feed to the various ways we have been helping advance women’s economic empowerment through access to financial services and made our program experts available to anyone who wished to ask us anything about the topic of the day.

With the support of Credit Suisse, Women’s World Banking is working with its network member SEWA Bank to design a unique savings program targeted to girls.

In honor of International Women’s Day on March 8, Women’s World Banking hosted an online roundtable with three alumni from our signature Women in Leadership program to reflect on their learnings from the program, how they have implemented these to become better leaders in their institution and ways this has inspired positive change among their colleagues and clients.

In 2012, an estimated 64 percent of Nigerians were unbanked and had never accessed any formal financial services or products, a number that is higher for women: nearly 73 percent of all Nigerian women are unbanked. This number does not include figures for the underbanked—men and women who have had

Investing in Women: The Role of Finance in Women’s Empowerment Date: Wednesday March 12, 2014 Time: 8-9 a.m. PST Venue: Webinar Register Now → Despite significant progress through global commitments to gender equality and women’s empowerment, developed and developing countries still face significant challenges in ensuring the equal treatment of

With 39 members across 28 countries, Women’s World Banking’s network is often faced with the tremendous challenge of operating in a crisis.

Last November, I had the great privilege of joining Women’s World Banking’s closest supporters on a trip to India. Our agenda was ambitious: four financial institutions; five cities; eleven days. Throughout the trip, we met the inspiring women entrepreneurs who are at the heart of every product introduction, piece of research, and leadership training led by Women’s World Banking.

Women’s World Banking Fellow Ramatolie recounts a visit with a male client of network member Microfund for Women in Jordan.

Women’s World Banking financial education lead Cathleen Tobin recaps the low-income salaried employees panel at last November’s “Building Women-Focused Finance” in Amman, Jordan.

Meeting women microentrepreneurs inspires an NYC highschool student to seek new opportunities

Our Senior Associate for Strategy responds to Maria Shriver’s essay on the Atlantic, “The Female Face of Poverty.”

Youth savings specialist Ryan Newton blogs about the youth panel during the “Building Women-Focused Finance” Conference in Amman, Jordan, November 20-21, 2013.

Summer intern Melisa spoke with Gil Lacson, Manager at the Network Engagement Team, to understand how the Fellowship Program at Women’s World Banking works. They also talked about his experience working at the organization for over 14 years.

MFW is a client-centric institution that prides itself on striving to meet their clients’ needs. In the process of analyzing the life cycle of their clients, they realized that there are many circumstances where clients face health-related issues that involve many expenses and often loss of income, all of which have a negative impact on the financial stability of the household, maternity and child birth being the most common. With Women’s World Banking’s support and product development expertise, MFW set out to create a product to cover clients facing those health emergencies.

Jaclyn Berfond, Senior Associate for Strategy at Women’s World Banking guest blogged on the Center for Financial Inclusion blog on the important of measuring a financial institution’s gender performance in order to know and track whether they are serving women well.

Women’s World Banking guest blogs on NextBillion about the necessity of gender performance measurement in microfinance.

Sameera got a loan from MFW to start her business (the first one for 1,000 dinar, approximately US$ 1,400). The beginning was especially tough, as she was the first woman to open a storefront business in the Sahab neighborhood, and the male shop owners didn’t approve of her presence. It took all her perseverance and strength to endure this harassment, but finally, she managed to gain acceptance and her business started to thrive.

Financial literacy for Hispanic women Twice a week I head down to volunteer at the Los Sures Social Services office, situated next to the local senior citizen home, to help at the food pantry. We distribute food to people in my neighborhood. Many are familiar faces. Many are middle-aged Hispanic

By Maura Hart, Manager, Public Relations Negros Women for Tomorrow Foundation (NWTF) was founded in time of crisis in the Philippines 29 years ago. Decades later, NWTF has seen its clients through countless typhoons (an average of 22 per year in the Philippines) and other natural disasters, experiences that proved invaluable when Typhoon Haiyan (known in the Philippines as Yolanda) hit in November.

We were in Amman, Jordan last week supporting Women’s World Banking’s 2013 Global Forum: Building Women-Focused Finance: The Global-Local Experience. Our first day began with a visit to the Amman headquarters of Microfund for Women (MFW), a Women’s World Banking network member and our gracious local host for the week.

By Melisa Socorro-Nunez, Global Marketing and Communications Intern

Summer intern Melisa recently sat down with Liannette Perez and talked about her experience at Women’s World Banking, first as Compliance Associate, then as a Fellow. Fellows rotate through four departments of the organization over a two year period.

Being a junior and learning about different colleges and careers makes it hard for me to only be interested in one field, but in my eyes business is one of the few majors that will allow me to explore most of the careers that I am currently interested in. Ten

We just concluded our Building Women-Focused Finance: The Global Experience conference in Amman and we are so excited about the quality of the presenters and the level of engagement from the audience of over 300 people from around the world. As Mary Ellen Iskenderian, our president and CEO, said in

Her Majesty Queen Rania Al Abdullah attended Women’s World Banking’s Building Women-Focused Finance: Middle East and North Africa Conference in Amman, Jordan. Queen Rania attends global conference to build women-focused finance by JT AMMAN — Her Majesty Queen Rania on Tuesday attended a global conference that aims to promote financial

We have just concluded the first day of our best practices conference in Amman, Jordan for the Middle East and North Africa (MENA) region, “Building Women-Focused Finance: the Global-Local Experience.” The agenda was packed with fascinating panels, bringing together Women’s World Banking staff, network members and industry experts to weigh

In less than 24 hours, Women’s World Banking will be kicking off its first conference for the Middle East and North Africa (MENA) region in Amman, Jordan, “Building Women-Focused Finance: the Global-Local Experience.” The impetus for holding a women-focused finance conference in MENA could not be clearer: only 13% of women have a formal savings account with 4% of women accessing a loan – these numbers are the lowest in the world and if not addressed, will prevent any significant economic growth for the region.

Our travel program recently returned from a ten day trip to India visiting our network members Ananya, FWWB, Ujjivan and SEWA Bank. One of the travelers shares his photo journal.

Women’s World Banking believes that in order to serve women well, we must understand the social, cultural and political context in which they live and the distinct financial needs that they face. And while women’s experiences and needs vary, from the Middle East to South Asia, one common finding is this: women’s work – both domestic and income-generating – is undervalued, if not completely disregarded, especially in rural communities across the world.

In an article that ran in the Times on October 28 (“Microcredit for Americans“), Jonathan Morduch made a bold statement, one we were glad to hear: Families in rural Africa are more like U.S. families than everyone wants to believe,” said Jonathan J. Morduch, the executive director of the Financial

Around the end of August, the weeks leading up to the Women in Leadership program (WIL) in Jordan, my team was glued to the news watching the events unfolding in Egypt, Syria and across the Middle East. Egypt had called a state of emergency and the Syrian crisis had come to a head with reports of chemical weapons and talk of a military strike. It was precisely this regional uncertainty that made it so important for us to go forward with the Women in Leadership program in Amman in September.

Women’s World Banking President and CEO Mary Ellen Iskenderian presented at this year’s TEDxWallStreet conference on the topic “Filling the Void.” Read the transcript of her talk.

Women’s World Banking intern Melisa sat down with Chief Investment Officer CJ Juhasz and talked about her impact investing work and interest in women’s issues.

Women’s World Banking board member and Self-Employed Women’s Association (India) founder Ela Bhatt recently gave the 15th annual Mahatma Ghandi Lecture on Nonviolence at McMaster University in Ontario, Canada. The event was held on October 3 and the title of Ela’s speech was: “Women and Poverty: The Hidden Face of Violence with Social Consent.”

Senior Associate Jaclyn Berfond and Ujjivan CEO and Women’s World Banking board member Samit Ghosh guest blogged for CGAP on the sometimes surprising benefits of measuring an institution’s gender performance.

Baboucarr Khan, CEO of Reliance Financial Services in the Gambia was joined by Reliance co-founder and COO Ismaila Faal along with Women’s World Banking team member Alejandra Rios to discuss the leadership implications of product innovation during a webinar hosted by Women’s World Banking.

Women’s World Banking celebrated its work empowering low-income women worldwide at the IAC Building in New York City, featuring the powerhouse panel of Anne-Marie Slaughter, Melanne Verveer and John Gerzema, moderated by Andrew Ross Sorkin.

Women’s World Banking develops innovative financial products to meet the dynamic needs throughout a woman’s life, but we start when she is a girl.

Women’s World Banking President and CEO Mary Ellen Iskenderian guest-blogged for CGAP’s ‘Gender and Finance’ blog series.

Thanks to television and Bollywood, Indian women have become more aware of new trends and demand an ever-expanding range of services for their hair, skin and nails from local beauty parlors. The result is that beauty parlors can be seen in almost every neighborhood and street, from low-income neighborhoods to busy streets and markets to posh suburbs.

September 23, 2013 Women’s World Banking had the privilege of participating in a collaborative workshop in Port Moresby, co-hosted by the Central Bank of Papua New Guinea (PNG) and the UNCDF Pacific Financial Inclusion Programme (PFIP), intended to generate ideas from a range of stakeholders to include in the strategy. This gave us a unique opportunity to utilize our research on the challenges and opportunities women face in accessing financial services in PNG to influence national policy, ensure that it includes a focus on women and to continue building our relationships with players in the Pacific region following our regional forum earlier this year.

It was heartening to see a Central Bank choosing to call together a diverse and mostly-local group of bankers, microfinance practitioners, women’s groups and representatives from savings and loan societies – alongside Women’s World Banking and the International Finance Corporation – to gather their perspectives on what the national strategy should look like. Each group presented their point of view and produced at the end of the workshop, a summary of recommendations that featured a wide range of opinions and targeting different constituencies.

We highlighted these key points from our research:

• There is an immense opportunity to serve women in PNG. Women are dramatically underserved by the financial services sector yet are just as likely as men to be earning. Women are important contributors to household. Our research showed that women need and want services to help them manage their money, including savings, loans and micro-insurance. Financial services providers should see serving women as not just a social cause but a real business opportunity.

• But women are tough customers. Winning the loyalty of PNG’s unbanked women will not be easy. Our research shows that to satisfy women, banking services need to be:

• Affordable and transparent: Women in PNG and elsewhere are unwilling to pay fees to save, such as the account maintenance fees and heavy withdrawal fees common in PNG. These fees effectively impact women more than men because they are usually poorer and have the responsibility of stretching their income to cover household expenses. Low fee, “no frills” accounts are offered by all of the PNG banks, yet there seem to be gaps in the outreach and awareness of these accounts. Most women in our study only knew about fee-based accounts.

• Secure: Women repeatedly emphasized PNG’s weak law and order environment and extremely high rates of domestic violence, which both pose serious risks for women’s physical well-being and their money if it is not locked away securely. Women also highlighted the risks of carrying money to and from their homes and businesses and said that carrying money to a bank branch may also not be safe. Mobile phone banking through neighborhood agents is therefore an attractive solution.

• Convenient: Working mothers everywhere know that they are the busiest people in the world! It’s no different in PNG. Mobile phone banking is not only great for security but offers a way to make banking much more convenient. But there is a gender gap in terms of access: PFIP found that 21% of women in urban areas do not have a phone, compared to just 9% of men. There’s also room to improve understanding and trust of mobile phone banking amongst women. GSMA found that 47% of women liked the idea but did not open a mobile money account because they didn’t understand the technology and 55% were not sure if mobile money is safe.

• Easy for illiterate customers: English is the language of the financial sector in PNG and many places, yet many women in Port Moresby (nearly 75% according to PFIP) are unable to communicate in English (a figure likely to be higher in rural and remote areas). Women’s World Banking believes in using visual and vernacular languages when creating marketing materials and forms to reduce this barrier.

The good news is that these are the features that both women and men want. If banks find ways to satisfy women through incorporating more of the features above, they will also gain men customers who have similarly been excluded from the banking sector.

Women’s World Banking shared these insights with the Central Bank, urging them to set targets to balance financial inclusion in PNG and to encourage more inclusive product design. The following inputs to the strategy were made, relating to a focus on women of the Central Bank:

• Set a target of 50% women served by the financial services sector, up from 30%, by 2015. Individual institutions should identify institutional targets for women’s financial inclusion and disaggregate gender data to track their progress.

• Lower the documentation requirements for opening an account (a barrier for women who do not have ID cards). This could include allowing women to use their affiliation with member-based groups, such as the Women’s Coffee Growers’ Association for example, as proof of identification for basic accounts.

• Work with the Ministry of Education to include financial education in the curriculum of public schools or vocational institutions, as an effort to start building financial literacy at a younger age to prepare more girls (and boys) to use financial services.

Women’s World Banking was proud to be able to contribute to and hopefully influence PNG’s national financial inclusion strategy. We’ll continue to look out for gains in women’s access in region, as we work on expanding financial inclusion for women around the world.

Saif Mohammad Moinul Islam, private sector engagement coordinator at Care Bangladesh, wrote a letter to to The Guardian Global Development Professionals Network last week with the provocative headline: "Domestic violence in Bangladesh: blame it on microfinance."

Women’s World Banking is pleased to welcome Ying (Susan) Gao, a 2013 Bryn Mawr College graduate, to the Program team as their intern.

Whether in a developed country such as the United States or in the low-income neighborhoods of Colombia, women are constantly making income decisions based on a social and cultural default that they are responsible for children and the household.

Women’s World Banking supporter Maureen O’Toole wrote of her travel experience in Tunisia earlier this year.

In celebration of our Community’s One Year Anniversary, we asked members to share photos of themselves working with their teams and to tell us their leadership philosophies. We are now pleased to share them with you through this video!

Youth Savings Specialist Ryan Newton guest blogged for Youth Economic Opportunities to share Women’s World Banking’s experience in designing financial education programs specifically for youth.

Summer intern Melisa recently sat down with Ines Marino and talked about her experience as a Fellow for Women’s World Banking.

Global Marketing and Communications summer intern Melisa had the opportunity to chat with Sandy Salama, who just arrived from Cairo to New York for her two-year fellowship at Women’s World Banking.

What are the financial lives of low-income garment employees like? This was one of the questions driving the research Women’s World Banking conducted in India during the early part of 2013.

All this week Women’s World Banking has been focusing on our youth savings work in honor of International Youth Day 2013. To cap it off, we’d like to share our extensive and interactive guide for deposit-taking microfinance institutions looking to offer or improve a youth savings program for their market.

“In the past, when I had money in my hand, I just go out and spend, but now whenever I get money, I just run and come here to save it.” – Lenege girl saver

Today we’re sharing the blogpost we wrote for microlinks back in 2012 about the youth savings product we developed in the Dominican Republic with network member Banco ADOPEM.

In 2008, Women’s World Banking began working with XacBank in Mongolia to develop a youth savings and financial education program, with support from the Nike Foundation, as part of the Girl Effect initiative.

In honor of this day, Women’s World Banking will be highlighting its youth savings work, which has implications for youth around the world – including migrants, which are the theme of this year’s Youth Day.

A new study from Thomson Reuters finds that companies with gender-diverse boards perform better than companies with zero women on their board. This echoes what the Center for Microfinance Leadership has known all along: that diverse perspectives lead to stronger decisions and healthier institutions…

Under Joyce Banda, Malawi’s economy is recovering, with manufacturing expected to grow six percent and agriculture 5.7 percent (World Bank) and respect for democracy and human rights has returned to the country (International Bar Association’s Human Rights Institute).

Mountains, low lands, wetlands, coastal areas, rainforests, islands… Sounds like an entire continent, but that geography is actually just one country’s: Papua New Guinea. With geography like that, you can imagine, getting anywhere is a real challenge.

Forging the right partnerships between Financial Service Providers (FSPs), Youth Serving Organizations (YSOs), and other key stakeholders, such as schools and local government, can be a key factor to successfully and sustainably serving youth clients.

Summer intern Melisa recently sat down with Ramatolie Saho and talked about her experience as a Fellow for Women’s World Banking. Fellows rotate through four departments of the organization over a two year period.

Fadi Al-Tawabin, a Microinsurance Officer at Microfund for Women Jordan, explains the development of the hospital cash microinsurance product provided by his institution, a product developed with Women's World Banking.

Marketplace Morning Report ran a story this morning (“Women stay in jobs longer than they should”) on women’s tenure in companies and the potential negative effect it can have on their career and salary growth. Is the answer to inspire women to be as mobile as their male counterparts? Not always.

In 2013, Women’s World Banking’s Center for Microfinance Leadership (CML) was given the incredible opportunity to create a new Senior Leadership Exchange to grow its own product offering while supporting the development of women leaders in microfinance.

In 2011 Women’s World Banking set-out to prove that providing low-income women with financial services is not charity but smart business.

Today, the United States of America celebrates its 237th day of independence from Great Britain. While Americans all over the world reflect on the over 200 years of democratic liberty they enjoy, we at Women’s World Banking would like to encourage everyone to spend a few minutes to think about

On the evening of Thursday, June 20th, we invited our closest supporters for a sneak peek of our new brand, visual identity and website.

It is with great pleasure that I announce that Sandy Salama from network member The Lead Foundation (Egypt) has been selected as the first network representative in the Women’s World Banking Fellowship Program.

From the shock of the financial crisis to the reputational hangover of the challenge in Andra Pradesh to the aftermath of the Arab Spring, there has been little calm in the storm.

A good leader is humble, human, honest, funny and a hard worker. An enthusiastic delegation from Women’s World Banking attended the 17th Annual Wharton Leadership Conference on June 19, entitled “Rising Up to Leadership”. As is always true of this incredible annual event, the conference speakers offered their reflections on

I’m so excited to introduce our new logo and website today! For more than 35 years, we have been the authoritative resource for the needs of low-income women. In the evolution of our work, we are serving more women than ever before with the essential tools and resources that allow

What empowerment means to a woman is complex. At Women’s World Banking, we focus on economic empowerment because we know that the ability to earn an income is linked to the ability to make decisions about how household money is allocated.

Women’s World Banking is a network of 39 financial companies across 28 countries that focus solely on women. Recognising the poor access women have to credit and savings instruments, WWB works to level the playing field. Mary Ellen Iskenderian, president and CEO of WWB, talks to TOI-CREST about why women need to treated

The Citi Foundation and Women’s World Banking team up to expand the Women in Leadership Program Women have played a critical role since the early days of microfinance, both in the founding of microfinance institutions (MFIs) and as a substantial portion of the client base. In recent years, as the

In a recent project we worked with our network member Microfund for Women (MFW, Jordan) to launch Ri’aya (The Caregiver Policy). Ri’aya is a unique micro‐health insurance product that provides a cash benefit after hospitalization to help with costs associated with loss of business, medical expenses, transportation and other household needs.

Many participants in our research in Cairo described Facebook as the real reason behind the Revolution. Facebook is well known by both Egyptian men and women, with many accessing the site through their mobile phones.

Microfinance has been operating in Egypt since the 90’s; however this has not created a market of savvy borrowers. Through our market research we found that the façade of interest-free Islamic loans has created a lack of clarity around interest rates and compounded the issue of low financial literacy among men

The total global population of girls ages 10 to 24 is expected to peak in the next decade. According to market research conducted by Women’s World Banking, girls as young as 10 years old regularly accumulate money, actively manage it and want a safe place to save it. Ana Laura lives in a low-income

Can you imagine if the only product that your bank offered you was a loan? Or trying to live without a bank account and having to conduct every payment with cash? Or seeing your entire business and all the assets you had painstakingly accumulated jeopardized by the costs of caring for a sick child?

More than 1.3 billion people globally live in poverty; the majority of them are women. The United Nations International Labour Office reports that women face substantially lower employment rates, have very little control over property and resources, are more prone to working in the informal sector with lower earnings.

If we add another solution to the mix, women have an even better chance to move from oppression to opportunity — economic empowerment. If women are to have a voice in the direction of their lives, they need basic financial services, including savings and insurance.

A growing chorus of voices is calling for a shift away from cash-based economies in the developing world. For governments, non-governmental organizations and companies focused on expanding financial access to the underserved, it is fast becoming a top priority. Not only is it too costly and unsustainable to reach people

“Ana Laura opened her first savings account at Banco ADOPEM in the Dominican Republic in April 2011. She closely monitors the money she has in her account, keeping track of the number and size of deposits she makes. Ana Laura recognizes that the bank not only provides more security than keeping her money at home, but she is also less tempted to spend it.